For the 24 hours to 23:00 GMT, GBP fell 0.04% against the USD and closed at 1.6365.

In the UK, the Bank of England Governor, Mervyn King stated that inflation remains “uncomfortably high,†and officials indicated that they need to raise interest rates later this year even as the economy struggles to build momentum.

In UK, the trade deficit increased to £7.7 billion in March, compared to a visible deficit of £7.0 billion recorded in February.

The pair opened the Asian session at 1.6365, and is trading at 1.6377 at 3.00GMT. The pair is trading 0.07% higher from the New York session close.

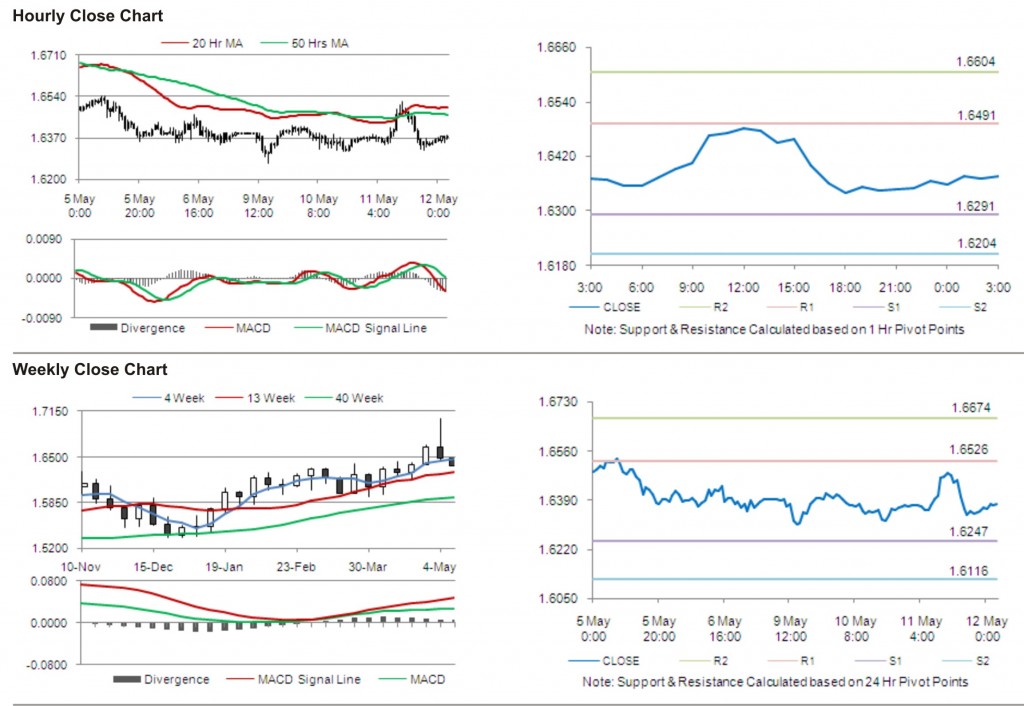

The pair has its first short term resistance at 1.6491, followed by the next resistance at 1.6604. The first support is at 1.6291, with the subsequent support at 1.6204.

With a series of UK economic releases today, including industrial production and manufacturing production, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.