For the 24 hours to 23:00 GMT, the EUR rose 0.49% against the USD and closed at 1.2732, continuing its previous session gains.

In economic news, the French business sentiment index unexpectedly fell to a level of 96.0 in September, down from previous month’s reading of 97.0. Market anticipations were for the business sentiment index to remain unchanged.

The ECB Vice President Vitor Constancio spoke in favour of the ECB’s recent measures in order to ward of very low inflation the Euro-zone. However, German Bundesbank President Jens Weidmann criticised the ECB’s recent plans to buy private sector bonds as according to him the central bank should have adopted structural reforms to be carried out in individual Euro-zone nations, rather than spend billions on private sector assets and transfer risks from banks to the ECB and ultimately to taxpayers.

In the US, the Fed in its latest monetary policy meeting revealed that policymakers intend to end its quantitative easing programme after this month and reiterated that interest rates would remain low for a considerable period of time. It also expressed concern that further strengthening in the greenback could hurt the US exports amid faltering economic growth in the Euro-zone, slowdown in China and Japan alongwith heightened geopolitical risks.

Separately, the Chicago Fed President, Charles Evans cautioned that the Fed should not raise its interest rates anytime sooner as it would be a blunder and urged that the central bank to remain patient on raising interest rates noting that there is still substantial slack in the labour market and significant underutilisation of the nation’s labour resources.

In other economic news, mortgage applications in the US rose 3.8% on a weekly basis in the week ended October 3, compared to a drop of 0.2% recorded in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.2728, with the EUR trading tad lower from yesterday’s close.

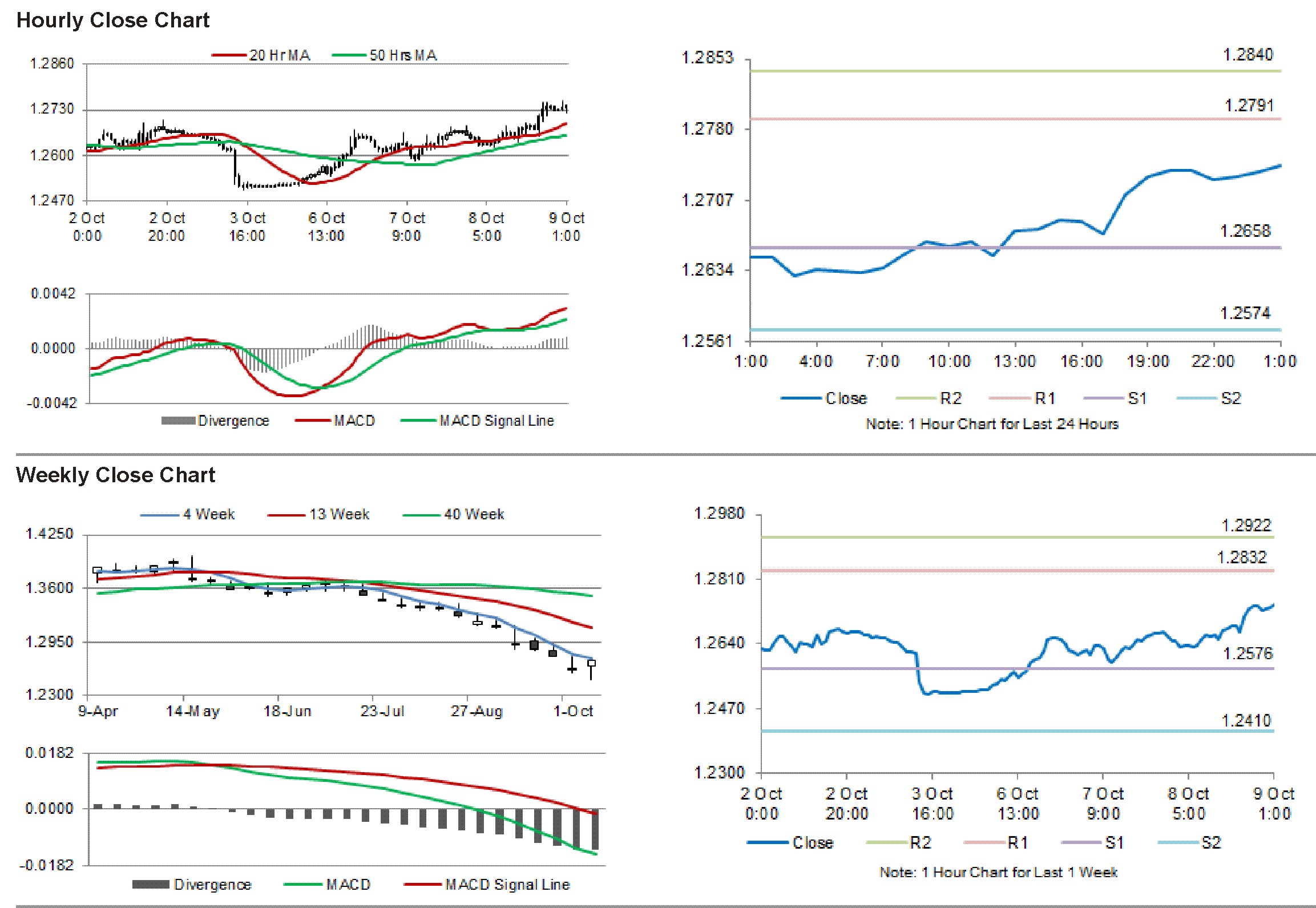

The pair is expected to find support at 1.2649, and a fall through could take it to the next support level of 1.2569. The pair is expected to find its first resistance at 1.2782, and a rise through could take it to the next resistance level of 1.2835.

Trading trends in the Euro today would be determined by Germany’s trade balance as well as current account data, set for release in a few hours from now. Meanwhile, investors keenly await initial jobless claims data from the US, scheduled later in the day.

The currency pair is trading above with its 20 Hr and 50 Hr moving averages.