For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.2736.

The greenback lost ground after durable goods orders data in the US surprisingly dropped 1.3% in September, decreasing for second consecutive month and compared to a decline of 18.3% recorded in August. Analysts were expecting it to register a rise of 0.5% in September.

However, losses were capped after the US consumer confidence unexpectedly hit a 7-year high reading of 94.5 in October, exceeding market forecasts to drop to a level of 87.0 and compared to previous month’s 89.0.

In other economic news, the Richmond Fed’s composite index of manufacturing activity in the nation jumped unexpectedly to a level of 20.0, compared to market expectations of a drop to a reading of 10.0. Meanwhile, the S&P’s annual growth in home sales prices slowed for the 8th successive month to 5.1% in August, down from 5.6% recorded in the prior month.

Elsewhere, in Germany, the import price index unexpectedly rebounded strongly to 0.3% on a monthly basis in September, more than market expectations for a fall of 0.1% and following a similar drop registered in the previous month.

In Italy, the business confidence index unexpectedly advanced to 96.0 in October, higher than market expectations of a fall to a level to 94.9.

Separately, the ECB’s Board Member, Peter Praet stated that the risks pertaining to deflation in the Euro-zone remain restricted and further assured that the single-currency region’s economy would not face any new financial crisis situation again.

In the Asian session, at GMT0300, the pair is trading at 1.2735, with the EUR trading marginally lower from yesterday’s close.

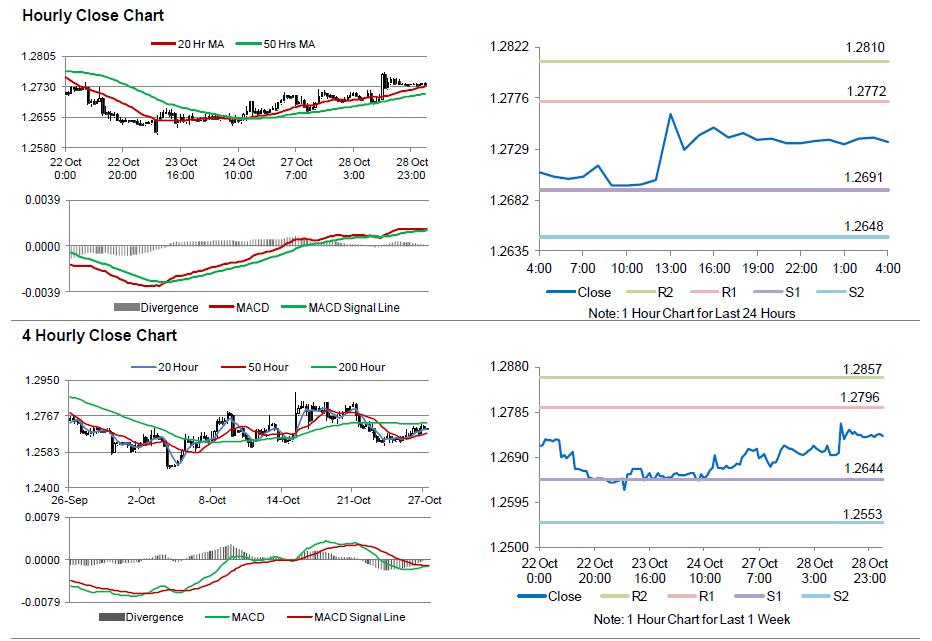

The pair is expected to find support at 1.2691, and a fall through could take it to the next support level of 1.2648. The pair is expected to find its first resistance at 1.2772, and a rise through could take it to the next resistance level of 1.2810.

Amid no economic data from the Euro-zone as well as from its peripheries, market participants anxiously wait for the outcome of the Fed’s monetary policy meeting, scheduled later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.