For the 24 hours to 23:00 GMT, the EUR declined 0.54% against the USD and closed at 1.2450, after the ECB President, Mario Draghi, in his testimony before the European Union’s Parliament, reinforced the central bank’s commitment of using additional unconventional measures if needed to stimulate growth in the Euro-economy, adding that buying sovereign bonds remains an option.

In other economic news, the Euro-zone’s seasonally adjusted trade balance expanded to €17.7 billion in September, exceeding market expectations to register a trade surplus of €16.0 billion and compared to previous month’s surplus of €15.4 billion.

Separately, the ECB’s Executive Board Member, Yves Mersch, cautioned about the negative effects of sovereign bond purchases by the central bank. He opined that Euro-zone economies should rather adopt closer fiscal and economic integration and structural reforms to boost growth.

The ECB’s Executive Board Member, Peter Praet opined that, “several factors that indicate credit dynamics in the Euro area have now reached a turning point” and as a result of which, policymakers expect that the central bank’s recently introduced monetary policy initiatives to “gain momentum in the coming months”.

In the US, industrial production unexpectedly retreated 0.1% in October, lower than market expected rise of 0.2% and following a revised increase of 0.8% recorded in September. Additionally, the nation’s capacity utilisation surprisingly dipped to a level of 78.9% in October from 79.2% in September and compared to market expectations for a reading of 79.3%. Meanwhile, the NY Empire State manufacturing index edged up to 10.16 in November, compared to a level of 6.17 registered in October. On the other hand, manufacturing production rose 0.2% in October, at par with market estimates.

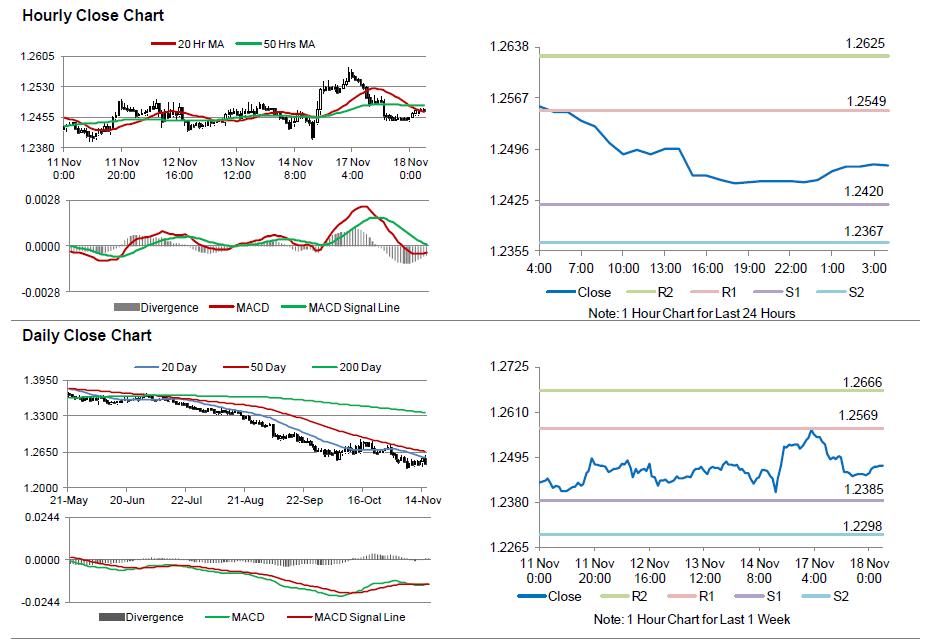

In the Asian session, at GMT0400, the pair is trading at 1.2473, with the EUR trading 0.18% higher from yesterday’s close.

The pair is expected to find support at 1.2420, and a fall through could take it to the next support level of 1.2367. The pair is expected to find its first resistance at 1.2549, and a rise through could take it to the next resistance level of 1.2625.

Trading trends in the Euro today are expected to be determined by Germany’s ZEW economic sentiment and current situation indices data, scheduled in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.