On Friday, GBP marginally declined against the USD and closed at 1.5555.

Last week, the Centre for Economics and Business Research (CEBR) revealed that the UK economy has overtaken France to become the world’s fifth largest economy. Furthermore, the CEBR forecasted the UK economy to pull further ahead of France in the coming years, with the nation’s nominal GDP forecast to increase to $2.95 trillion in 2019, compared with $2.67 trillion in France.

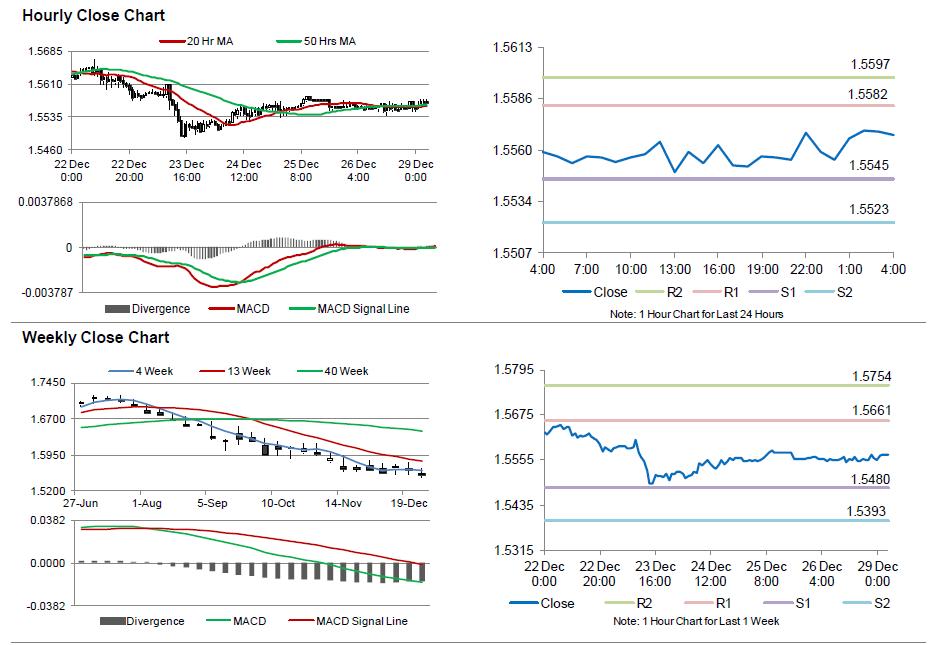

In the Asian session, at GMT0400, the pair is trading at 1.5568, with the GBP trading 0.08% higher from Friday’s close.

The pair is expected to find support at 1.5545, and a fall through could take it to the next support level of 1.5523. The pair is expected to find its first resistance at 1.5582, and a rise through could take it to the next resistance level of 1.5597.

Amid a light economic calendar this week, investors would focus on the release of manufacturing PMI, mortgage approvals and net lending to individual data from the UK slated near the end of the week.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.