On Friday, the AUD strengthened 0.07% against the USD to close at 0.8121.

In economic news, Chinese industrial profits fell 4.2% in November, recording the highest annual decline since August 2012. On a YTD basis, industrial profits advanced 5.30% on a YoY basis, in November. In the previous month, industrial profits (YTD) had recorded a rise of 6.70%.

LME Copper prices marginally declined or $2.0/MT to $ 6361.0/MT. Aluminium prices declined 1.0% or $18.0/MT to $ 1834.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8130, with the AUD trading 0.11% higher from yesterday’s close.

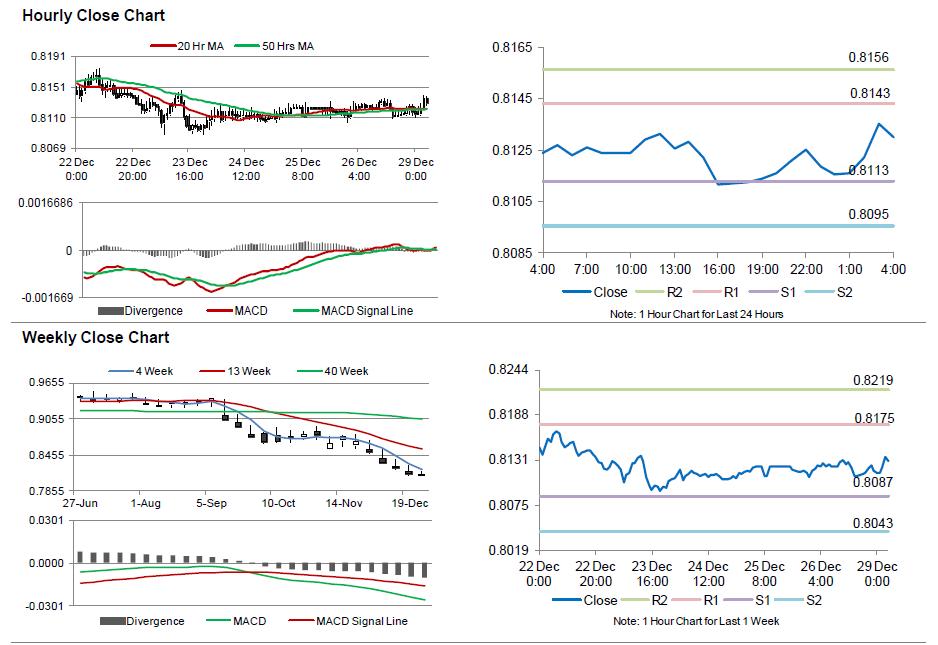

The pair is expected to find support at 0.8113, and a fall through could take it to the next support level of 0.8095. The pair is expected to find its first resistance at 0.8143, and a rise through could take it to the next resistance level of 0.8156.

This week, Australia’s private sector credit data, AiG Performance of Manufacturing Index and RBA Commodity Index are scheduled to be released.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.