For the 24 hours to 23:00 GMT, the USD declined 0.15% against the CAD to close at 1.1955.

In the Asian session, at GMT0400, the pair is trading at 1.1988, with the USD trading 0.28% higher from yesterday’s close.

Early this morning, the BoC’s Deputy Governor, Timothy Lane warned that sliding oil and commodity prices are putting Canada’s “post-recession” economy at risk, as it would impact investment in the nation’s oil sector, which accounts for about 3% of Canada’s GDP.

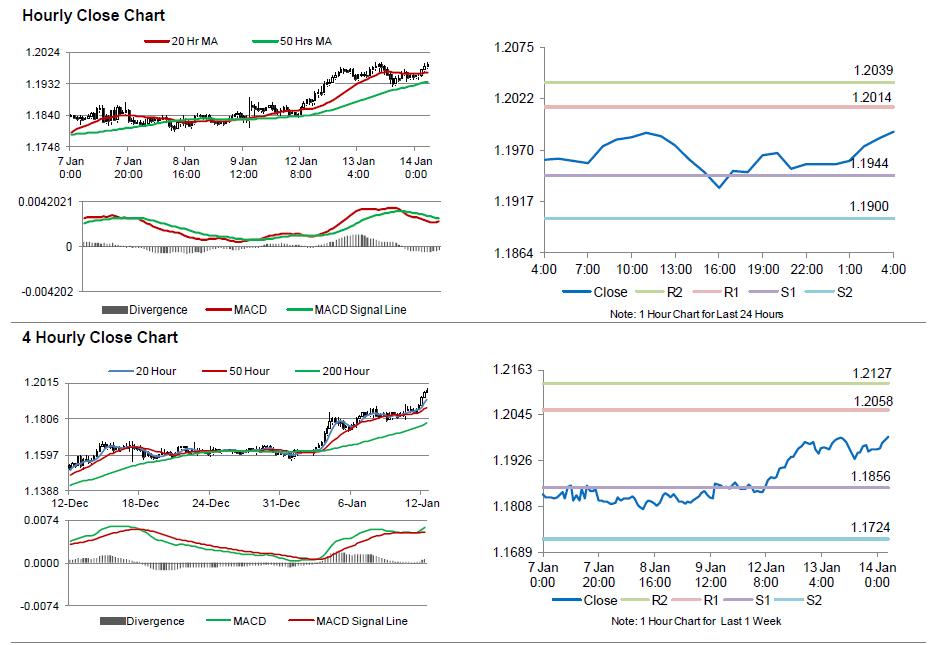

The pair is expected to find support at 1.1944, and a fall through could take it to the next support level of 1.1900. The pair is expected to find its first resistance at 1.2014, and a rise through could take it to the next resistance level of 1.2039.

Amid a thin economic calendar in Canada today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.