For the 24 hours to 23:00 GMT, the EUR rose 1.23% against the USD and closed at 1.1477, on the back of stronger than expected factory orders data in Germany, coupled with the European Commission’s upbeat assessment about the Euro-economy.

Data showed that German factory orders rebounded 4.2% on a monthly basis, registering more than a 6-year high in December and beating market expectations for a 1.5% rise. It followed a drop of 2.4% recorded in November.

Separately, the European Commission (EC) expressed its optimistic view about the Euro-economy and upgraded the Euro-zone’s economic growth forecast to 1.3% and 1.9% for 2015 and 2016 from its 3-month earlier estimation of 1.1% and 1.7% growth. Furthermore, the EC opined that the sharp decline in oil prices since mid-2014 might boost sluggish GDP growth in the economy.

Yesterday, the ECB, in its monthly bulletin, reiterated that the asset purchase program will continue till September 2016. Further, the central bank stated that the asset purchase would continue till inflation shows gradual improvement towards the ECB’s target.

In the US, the seasonally adjusted initial jobless claims climbed to 278.0 K in the week ended 31 January and compared to a revised reading of 267.0 K in the previous week. Markets were anticipating initial jobless claims to rise to a level of 290.0 K. Meanwhile, the nation’s trade deficit surprisingly widened to $46.6 billion in December, compared to market expectations of a drop to $38.0 billion and compared to a revised trade deficit of $39.8 billion in the previous month.

Yesterday, the Boston Fed President, Eric Rosengren urged the Fed to refrain from abandoning its “patient” approach on interest rate hikes.

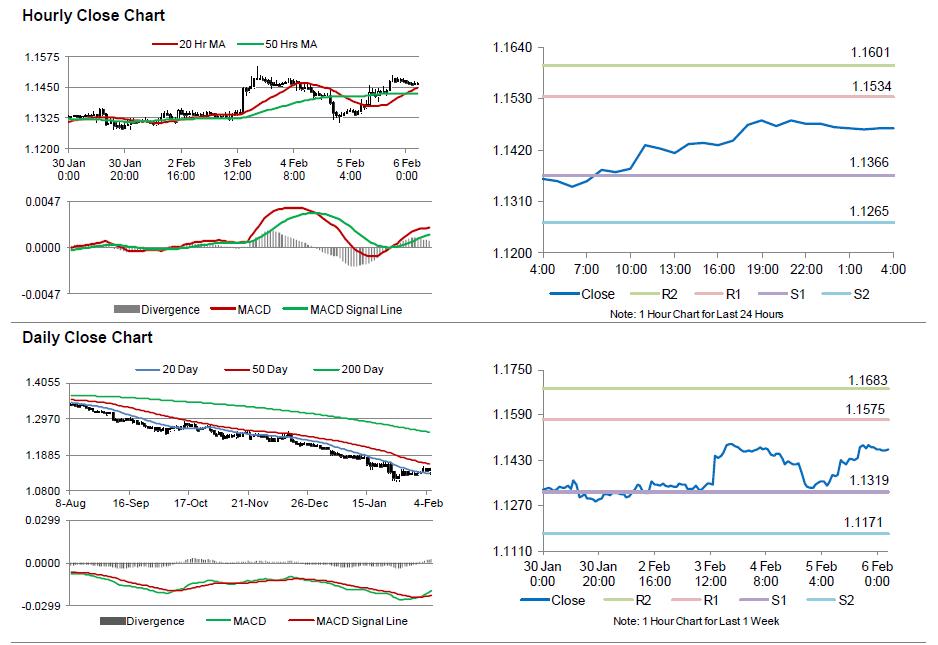

In the Asian session, at GMT0400, the pair is trading at 1.1467, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.1366, and a fall through could take it to the next support level of 1.1265. The pair is expected to find its first resistance at 1.1534, and a rise through could take it to the next resistance level of 1.1601.

Trading trends in the pair today are expected to be determined by Germany’s industrial production data, scheduled in few hours. Meanwhile, non-farm payrolls and unemployment rate data from the US, scheduled later today would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.