For the 24 hours to 23:00 GMT, USD traded flat against the JPY, on Friday, and closed at 81.71, as the Bank of Japan stated that the economy continues to face downward pressure as showed by the gross domestic product report.

The Bank of Japan (BoJ), on Friday, unanimously decided to maintain the uncollateralized overnight call rate in the range of 0.0% to 0.1%. The apex bank also maintained its assessment of the domestic economy, indicating that “Japan’s economy faces strong downward pressure, mainly on the production side, due to the effects of the earthquake disaster”.

In Japan, the all industry activity index, on a monthly basis, declined by 6.3% in March, following a 0.7% growth recorded in the previous month. Meanwhile, the convenience stores sales, on annual basis, rose 1.6% to ¥604.4 billion in April.

In the Asian session at 3:00GMT, the pair is trading higher from the New York close, by 0.24%, at 81.91.

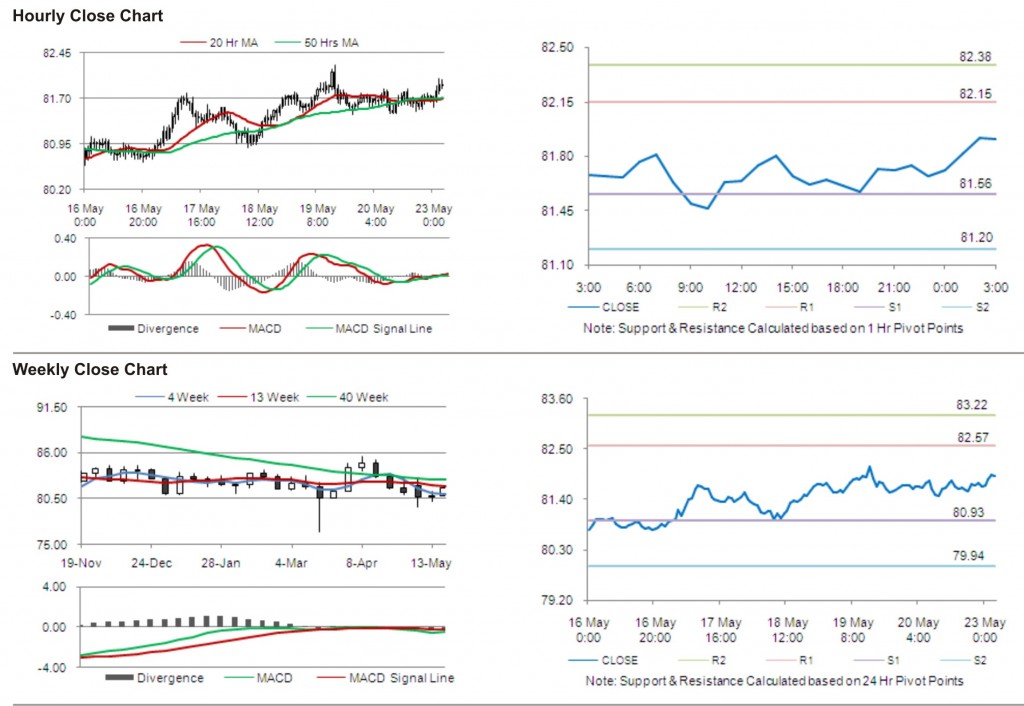

The first short term resistance is at 82.15, followed by 82.38. The pair is expected to find support at 81.56 and the subsequent support level at 81.20.

Trading trends in the pair today are expected to be determined by release of leading economic index and coincident index in Japan.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.