For the 24 hours to 23:00 GMT, the EUR rose 1.46% against the USD and closed at 1.1343, after the final estimate of the Euro-zone’s services PMI rose more than expected in April.

Yesterday, the Euro-zone’s services PMI rose to 54.1 in April, compared to market expectations to remain unchanged from previous month’s reading of 53.7.

Other economic data showed that retail sales in the single-currency bloc retreated more than expected by 0.8% MoM in March, posting its first drop since last September and compared to a revised gain of 0.1% registered in the preceding month.

The greenback lost ground, after the private sector employment in the US advanced by 169.00 K in April, lower than market expectations of an advance of 200.00 K and compared to a revised gain of 175.00 K in the prior month.

In speeches, the Fed Chairwoman, Janet Yellen, highlighted that the current equity market valuations seem to be quite high and expressed concern that it could pose potential dangers, however she added that stability risks across the nation’s financial system remained in check. Separately, the Atlanta Fed President, Dennis Lockhart, opined that he was not overly concerned with the weak growth rate and expected the US economy to recover in the second quarter. He further added that he expects the Fed to raise interest rates sometime in the middle of the year.

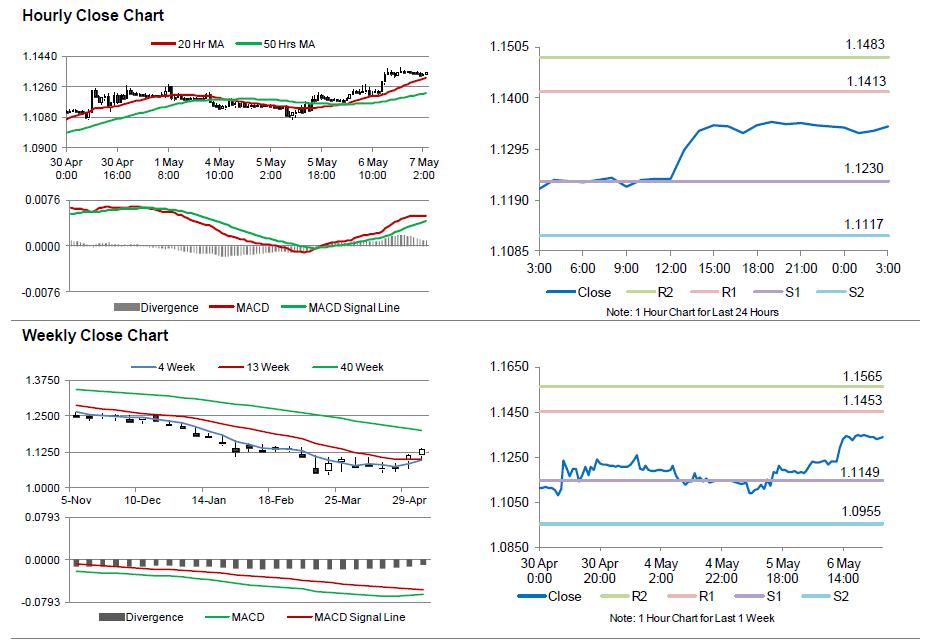

In the Asian session, at GMT0300, the pair is trading at 1.1342, with the EUR trading flat from yesterday’s close.

The pair is expected to find support at 1.1230, and a fall through could take it to the next support level of 1.1117. The pair is expected to find its first resistance at 1.1413, and a rise through could take it to the next resistance level of 1.1483.

Trading trends in the pair today are expected to be determined by Germany’s construction PMI data, scheduled in a few hours. Meanwhile, investors keenly await the US initial jobless claims data, scheduled to release ahead in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.