For the 24 hours to 23:00 GMT, the EUR rose 0.46% against the USD and closed at 1.1403, after the ECB Chief, Mario Draghi mentioned that the economic stimulus program was working and the central bank will continue with its €1.1 trillion money printing scheme until its objectives were fully achieved.

In the US, data showed that number of people claiming unemployment benefits for the first time unexpectedly eased to 264.0K in the week ended 09 May, compared to market expectations of an advance to 273.0K. In the prior week, initial jobless claims had registered a reading of 265.0K. On the other hand, the producer price index unexpectedly dropped 0.40% MoM, less than market expectations for an advance of 0.10%. It had recorded a rise of 0.20% in the previous month.

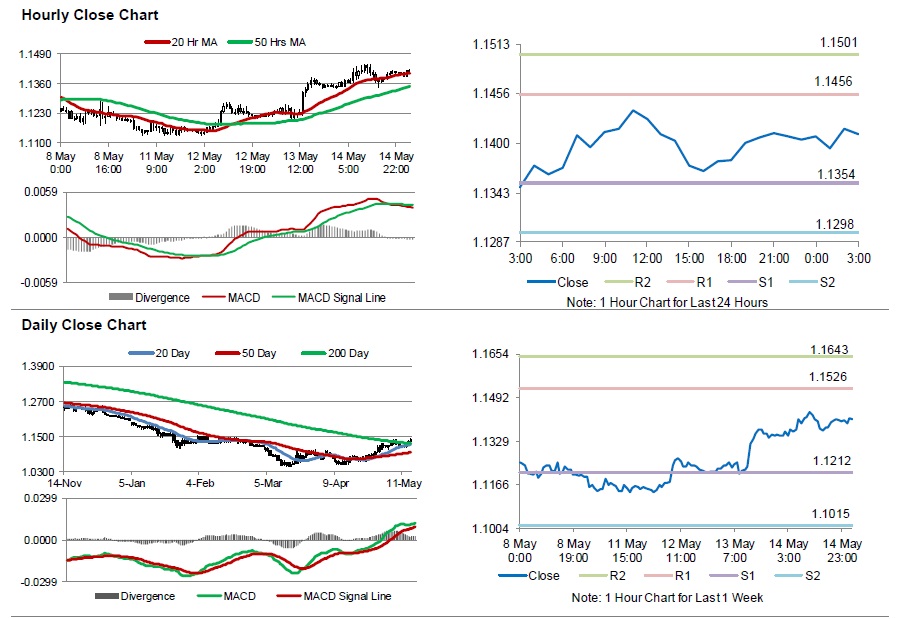

In the Asian session, at GMT0300, the pair is trading at 1.1410, with the EUR trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.1354, and a fall through could take it to the next support level of 1.1298. The pair is expected to find its first resistance at 1.1456, and a rise through could take it to the next resistance level of 1.1501.

Amid no economic releases in the Euro-zone today, all eyes would be on Germany’s ZEW economic survey data as well as Euro-zone’s inflation data, scheduled next week. Meanwhile, the US industrial production data, scheduled later today would generate lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.