For the 24 hours to 23:00 GMT, GBP rose 0.55% against the USD and closed at 1.6181. However, gains were capped after Moody’s Investors Service stated that it may lower the credit ratings of 14 British lenders and after a report showed the UK budget deficit widened in April.

In the UK, the public sector net borrowing, excluding financial interventions rose to £10.0 billion in April, compared to a total borrowing of £7.3 billion recorded in the same period last year. The Confederation of British Industry (CBI) indicated that around 41.0% of retailers stated that sales volume increased in the two weeks to 16 May 2011, while 23.0% reported a decline. The resulting balance of +18.0%, was above market expectations for a reading of +10.0%. The sales balance stood at a reading of +21.0% in April.

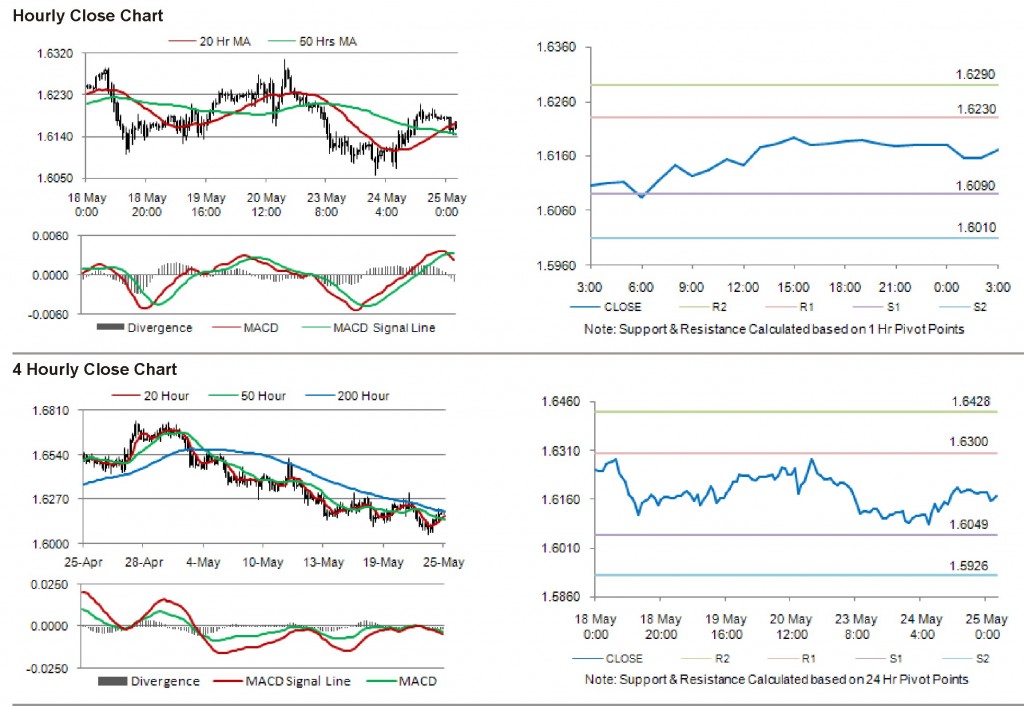

The pair opened the Asian session at 1.6181, and is trading at 1.6171 at 3.00GMT. The pair is trading 0.06% lower from the New York session close.

The pair has its first short term resistance at 1.6230, followed by the next resistance at 1.6290. The first support is at 1.6090, with the subsequent support at 1.6010.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.

With a series of UK economic releases today, including total business investment and gross domestic product, trading in the pair is expected to be influenced by the resulting cues from these releases.