For the 24 hours to 23:00 GMT, USD strengthened 0.21% against the JPY and closed at 82.09.

The minutes of Bank of Japan’s (BoJ) latest meeting indicated that the sentiment on the BoJ’s board is for further credit easing and expanding asset purchase.

The Japanese government maintained its downbeat assessment of the nation’s economy in May. The government downgraded its assessments of capital spending by firms, corporate earnings and housing starts.

In Japan, this morning, the merchandise trade deficit stood at ¥463.7 billion in April, compared to an upwardly revised merchandise trade surplus of ¥189.4 billion recorded in the previous month.

In the Asian session at 3:00GMT, the pair is trading lower from the New York close, by 0.26%, at 81.88.

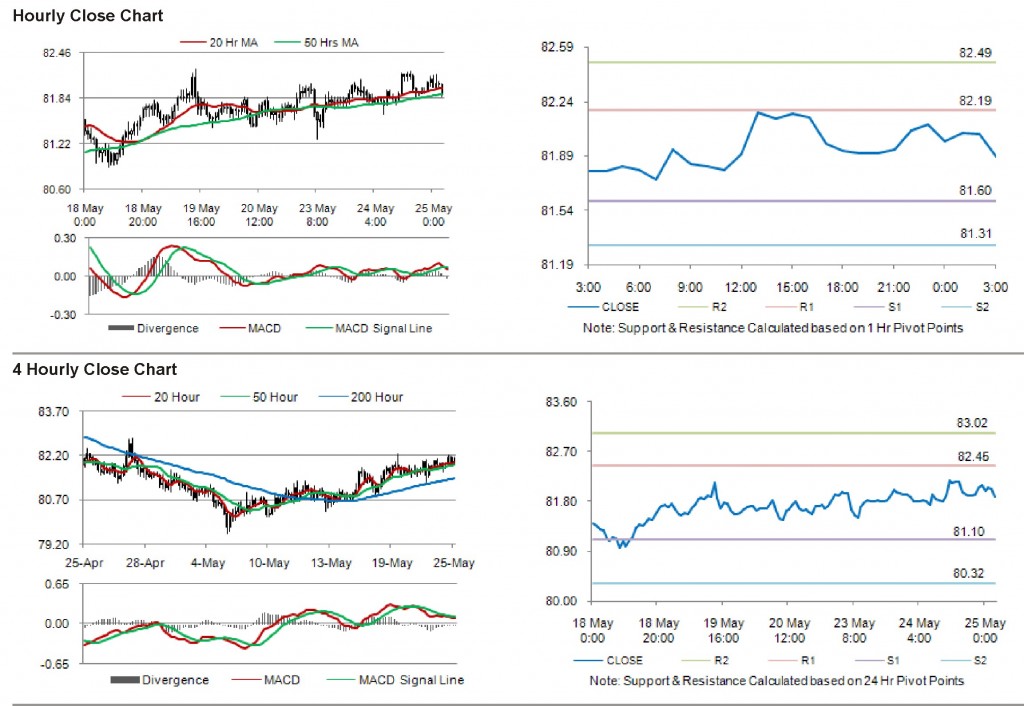

The first short term resistance is at 82.19, followed by 82.49. The pair is expected to find support at 81.60 and the subsequent support level at 81.31.

Investors are eying BoJ’s Governor Shirakawa speech along with other economic releases in the Japan to be released later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.