For the 24 hours to 23:00 GMT, AUD weakened 0.20% against the USD to close at 1.0534.

In Australia, the Australian private capital expenditure index, on quarterly basis, rose by 3.4% in the first quarter of 2011, following 1.3% increase in the previous quarter. Meanwhile, the Reserve Bank of Australia Deputy Governor, Ric Battellino stated that household borrowing in Australia may continue to grow at a subdued pace in the coming months as borrowers cut back their demand for credit to avoid high indebtedness.

In the US, the housing price index, on monthly basis, decreased by 0.3% in March compared to the decline of 1.5% in February.

In the Asian session at 3:00GMT, the pair is trading at 1.0583, 0.47% higher from the New York session close, as investors bet on higher-yielding currencies on firmer commodity prices.

LME Copper prices rose 1.5% or $137.3/MT to $9,018.5/ MT. Aluminium prices rose 1.6% or $40.3/MT to $2,539.8/ MT.

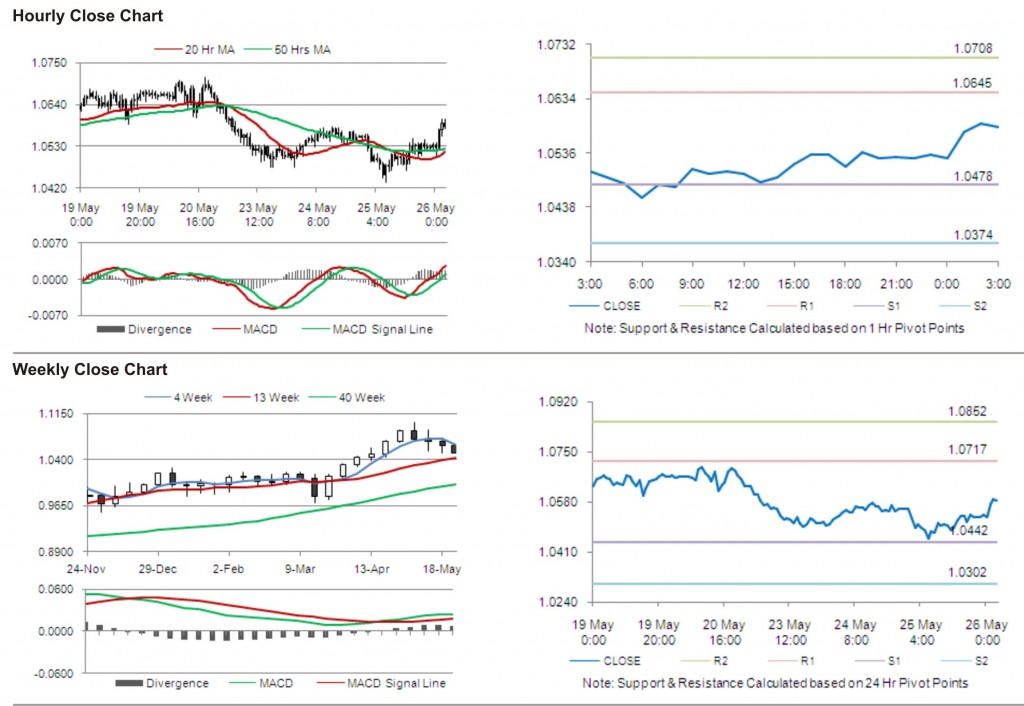

The pair is expected to find first short term resistance at 1.0645, with the next resistance levels at 1.0708 and 1.0875, subsequently. The first support for the pair is seen at 1.0478, followed by next supports at 1.0374 and 1.0207 respectively.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.