For the 24 hours to 23:00 GMT, the EUR declined 0.06% against the USD and closed at 1.1071.

Yesterday, the Greek government presented new economic reform proposals to its creditors in order to secure a new bailout package, as well as to determine the nation’s future in the Euro-zone.

Economic data released showed that Germany’s seasonally adjusted trade surplus unexpectedly expanded to €22.8 billion in May, compared to prior month’s surplus of 21.5 billion in April. Market expectations were for it to drop to €21.0 billion. Meanwhile, the nation’s current account surplus narrowed more than anticipated to €11.1 billion in May, following a revised surplus of €21.2 billion in the previous month.

In the US, people claiming jobless benefits for the first time surprisingly jumped to 297 K in the week ended 04 July 2015, compared to prior week’s level of 282 K. Markets were expecting initial jobless claims to ease to 277 K.

Separately, the IMF dragged down the global economic outlook to 3.3% from 3.5% estimated three months ago, but it kept its 2016 prediction unchanged at 3.8%, citing a weak start in the US with harsh winter as the main culprit. Additionally, it also cut the outlook for US growth to 2.5% in 2015, from 3.1% earlier.

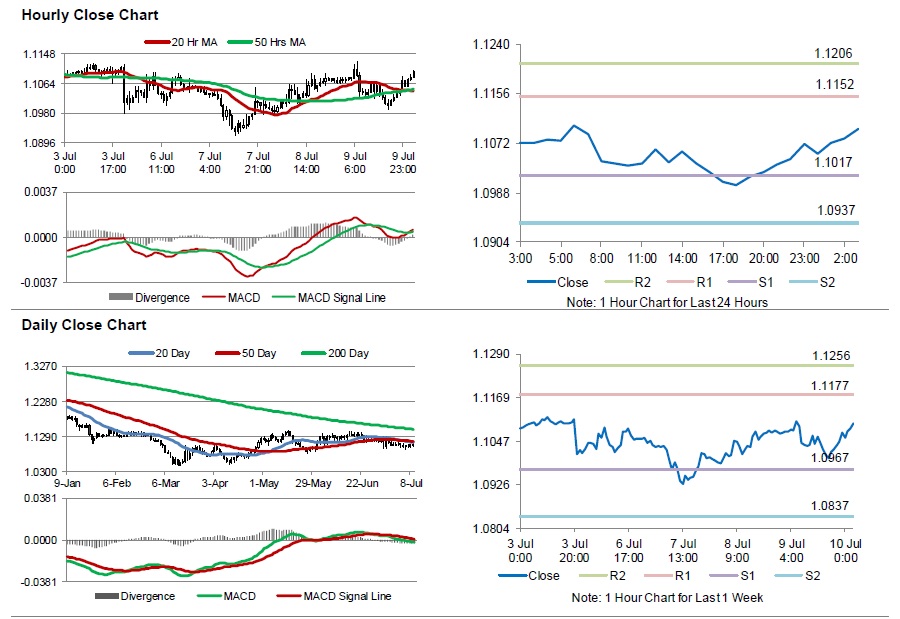

In the Asian session, at GMT0300, the pair is trading at 1.1098, with the EUR trading 0.24% higher from yesterday’s close.

The pair is expected to find support at 1.1017, and a fall through could take it to the next support level of 1.0937. The pair is expected to find its first resistance at 1.1152, and a rise through could take it to the next resistance level of 1.1206.

Moving ahead, Greece’s fate will be determined by the Euro-zone officials, as it holds an emergency summit on Sunday to determine if Greece’s proposed plan of “credible reforms” are feasible or not. Meanwhile, investors would pay close attention to the Fed Chief, Janet Yellen’s speech, scheduled later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.