For the 24 hours to 23:00 GMT, EUR rose 1.32% against the USD, on Friday, and closed at 1.4319, as poor US economic data raised speculation that the Federal Reserve may delay an interest-rate hike.

In the US, the personal consumption expenditure, on monthly basis, dropped to 0.4% in April from 0.5% in March. Additionally, the pending home sales slumped 11.6% in April.

In the Euro zone, the money supply rose by 2.0% (Y-o-Y) in April from 2.3% increase in March. Meanwhile, the economic sentiment indicator fell to 105.5 in May from 106.1 in April. The industrial sentiment index fell to 3.9 in May from 5.6 in April. Additionally, the consumer confidence rose to -9.8 in May from -11.6 in April.

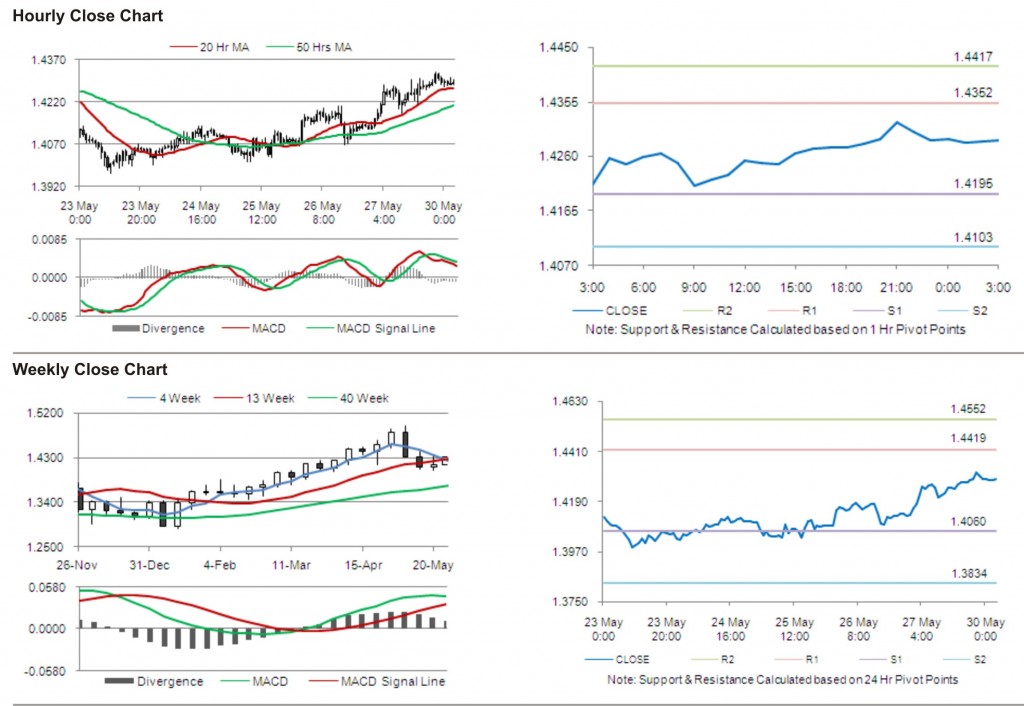

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4287, 0.22% lower from the Friday’s close at 23:00GMT.

The pair has its first short term resistance at 1.4352, followed by the next resistance at 1.4417. The first support is at 1.4195, with the subsequent support at 1.4103.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.