For the 24 hours to 23:00 GMT, the AUD strengthened 1.38% against the USD to close at 0.7031.

LME Copper prices rose 2.01% or $104.0/MT to $5280.0/MT. Aluminium prices rose 0.35% or $5.5/MT to $1593.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7050, with the AUD trading 0.28% higher from yesterday’s close.

In early session, Australia’s Westpac consumer confidence collapsed and ended in negative territory due to global economic concern, falling commodities prices and disappointing report on Australia’s growth rate, after posting a strong number in last month. Meanwhile Australia’s Home Loans data missed expectation, recorded a sluggish growth of 0.30% compared with 4.40% in last month.

Separately, the RBA Deputy Governor Philip Lowe’s expressed confidence over Australian economy and remains optimistic about economic prospects. Further, he added that weaker Australian dollar, low interest rates and lower labour market will support Australian growth. He also opined that the missing ingredient of the economic recovery was investment in non-mining industries.

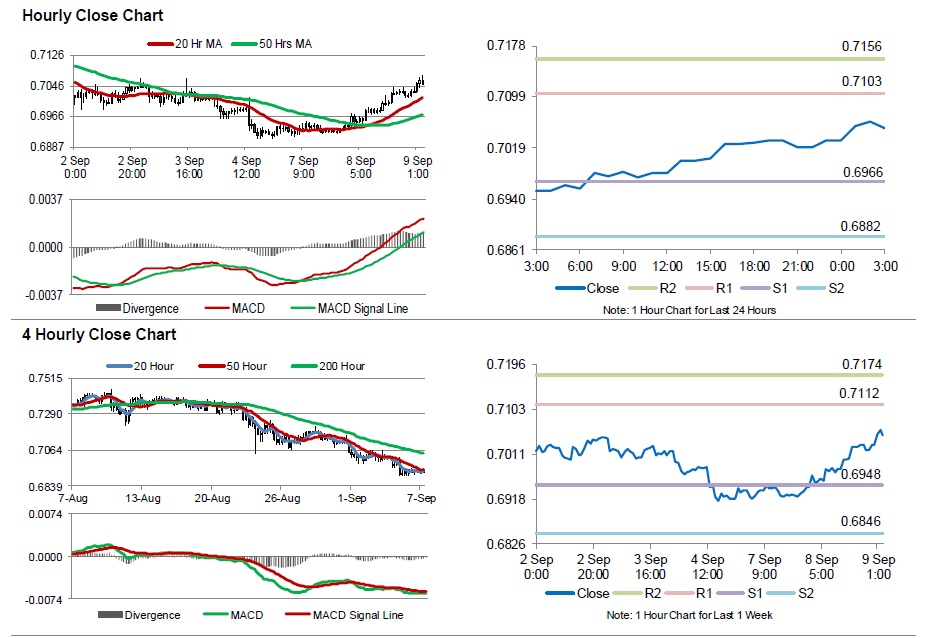

The pair is expected to find support at 0.6966, and a fall through could take it to the next support level of 0.6882. The pair is expected to find its first resistance at 0.7103, and a rise through could take it to the next resistance level of 0.7156.

Going forward investor will keep a close eye on Australia’s consumer inflation expectation and employment data, scheduled in the early hours of tomorrow.

The currency pair is trading above 20 hr and 50 hr moving averages.