On Friday, the AUD strengthened marginally against the USD to close at 0.7081.

China, Australia’s biggest trading partner, showed that new yuan loans for August rose 809.6 billion, a decline from July’s level of 1,480.0 billion.

LME Copper prices declined 0.89% or $48.0/MT to $5352.0/MT. Aluminium prices rose 0.44% or $7.0/MT to $1614.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7107, with the AUD trading 0.37% higher from Friday’s close.

Over the weekend, China reported a 10.8% rise in its annual retail sales, beating a market expectations and previous month’s figure of 10.5%. Meanwhile, the industrial production of the country rose less than expected by 6.1% YoY in August, against July’s 6.0% rise.

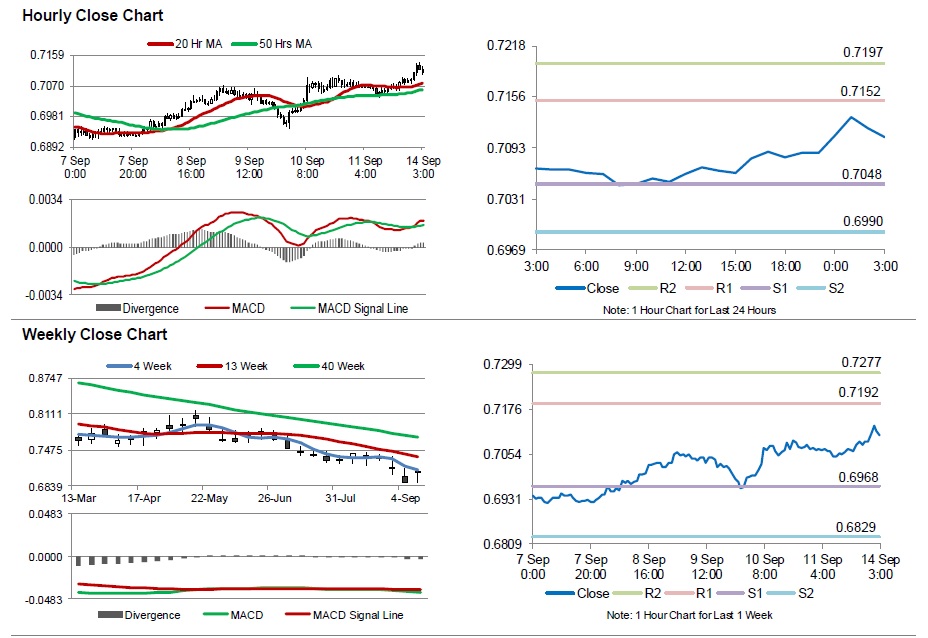

The pair is expected to find support at 0.7048, and a fall through could take it to the next support level of 0.6990. The pair is expected to find its first resistance at 0.7152, and a rise through could take it to the next resistance level of 0.7197.

Looking ahead, markets will concentrate on Australia’s minutes of RBA’s last monetary policy meeting, scheduled in the early hours of tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving average.