For the 24 hours to 23:00 GMT, the EUR rose 0.40% against the USD and closed at 1.1234, on the back of strong macroeconomic data from Euro-zone’s third-largest economy.

Data showed that Italy’s consumer confidence and business confidence index in September reached its highest level in more than two years.

Meanwhile, the greenback lost ground after the US pending home sales fell 1.4% in August, compared to a rise of 0.5% in July, due to a rise in home prices and a limited supply of homes in the market. Investors had expected a 0.4% rise. Dallas Fed survey revealed a negative figure, the 9th in a row, albeit better than previous month’s print. The overall US consumption reported suggested recovery as the growth in personal spending rose more-than-expected in August, while the growth in personal income slowed down slightly after a spurt in July.

Separately, the New York Fed President, William Dudley, stated that the central bank is likely to increase the short-term interest rates this year, brushing aside fears of a weak global economy. He further stated that the rate hike is likely to be implemented in late October or mid-December.

In addition, San Francisco Fed President, John Williams, also stated that the central bank would start raising interest rates gradually later this year as the country has made good progress, which is likely to continue and will continue to make on set path.

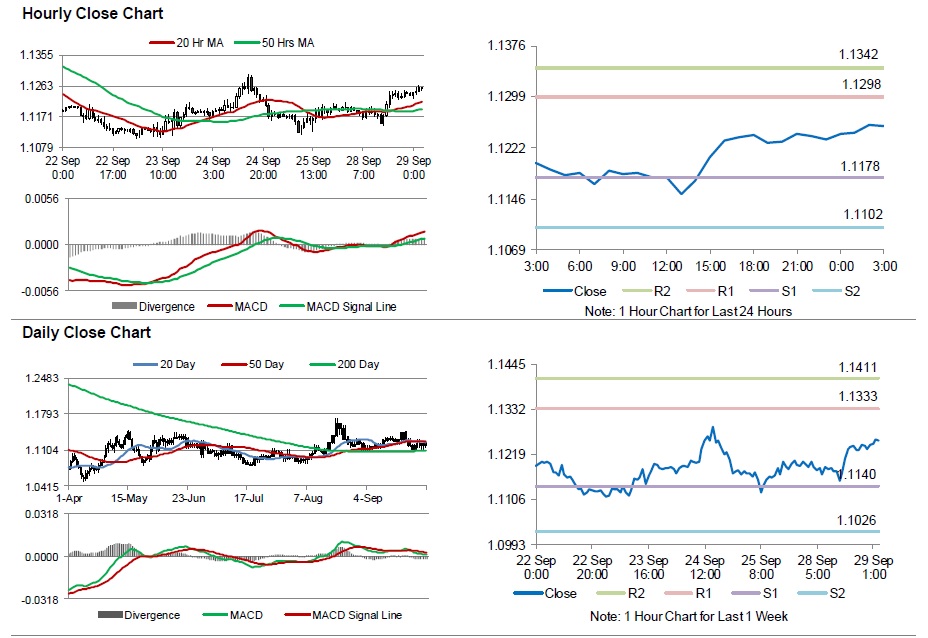

In the Asian session, at GMT0300, the pair is trading at 1.1254, with the EUR trading 0.18% higher from yesterday’s close.

The pair is expected to find support at 1.1178, and a fall through could take it to the next support level of 1.1102. The pair is expected to find its first resistance at 1.1298, and a rise through could take it to the next resistance level of 1.1342.

Going ahead, investors would look forward to the release of Germany’s preliminary consumer prices data for September, scheduled to release in a few hours. US consumer confidence data for the same month would also fetch investor attention, due later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.