For the 24 hours to 23:00 GMT, the USD declined 0.39% against the CAD to close at 1.3007.

The CAD gained ground, after the Canadian housing starts in September recorded its fastest pace since 2012.

Data showed that the country’s seasonally adjusted annual rate of housing starts for September, surprisingly rose to 230.7k units in September, from 214.3k units in August, while investors had expected the reading to drop to 202.5k units.

In the Asian session, at GMT0300, the pair is trading at 1.298, with the USD trading 0.20% lower from yesterday’s close.

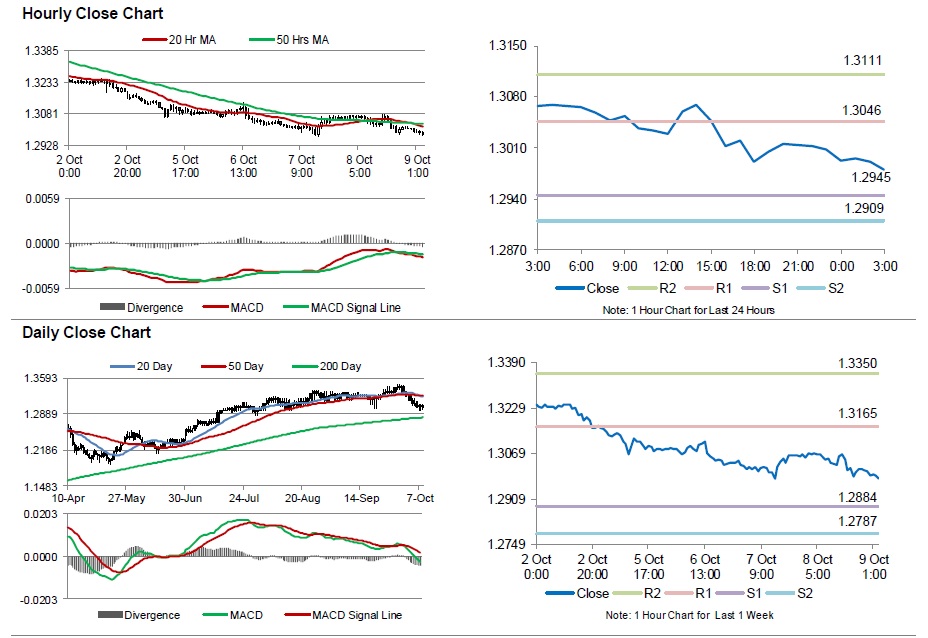

The pair is expected to find support at 1.2945, and a fall through could take it to the next support level of 1.2909. The pair is expected to find its first resistance at 1.3046, and a rise through could take it to the next resistance level of 1.3111.

Moving ahead, investors will closely monitor Canada’s unemployment rate data for September, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.