For the 24 hours to 23:00 GMT, the AUD strengthened 0.72% against the USD to close at 0.7256.

LME Copper prices declined 1.55% or $81.0MT to $5160.0/MT. Aluminium prices declined 0.96% or $15.0/MT to $1552.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7269, with the AUD trading 0.19% higher from yesterday’s close.

Early morning data showed that Australian home loans climbed 2.9% in August, from a downwardly revised 0.3% decline in July, and missing forecasts for an increase of 4.7%. In addition to this, investment lending in the country fell 0.4% in August, from a downward revised decline of 0.3% in July.

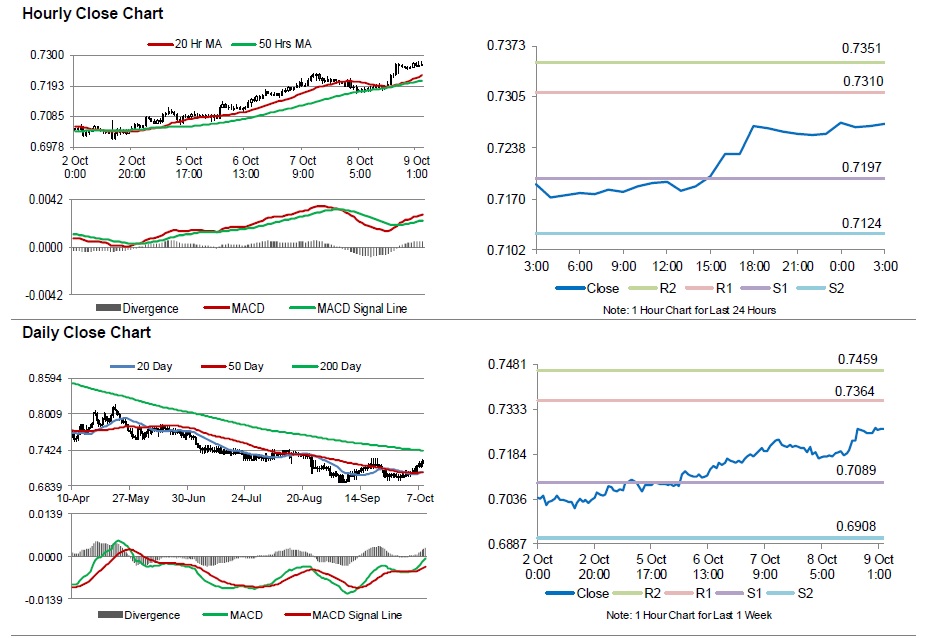

The pair is expected to find support at 0.7197, and a fall through could take it to the next support level of 0.7124. The pair is expected to find its first resistance at 0.731, and a rise through could take it to the next resistance level of 0.7351.

Moving ahead, market participants will closely monitor Australia’s NAB business confidence, consumer inflation expectation and full time employment change data, scheduled to be released next week. In addition to this, China’s consumer price and producer price inflation data for September, also scheduled to release next week, will grab a lot of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.