For the 24 hours to 23:00 GMT, the EUR rose 0.44% against the USD and closed at 1.1289.

Yesterday, Germany’s trade surplus fell more-than-expected to €15.3 billion in August, from €25.0 billion in July, as the nation’s exports recorded its steepest drop in almost seven years.

Separately, the ECB in its meeting accounts, indicated that the central bank will not hesitate from increasing its existing stimulus program if needed, to address the risks of too-low inflation.

In the US, minutes from the FOMC September 16-17 meeting showed that the Fed officials were pretty confident about the US economy and added that the possibility of a rate this year is still possible. The minutes also indicated that the Fed policymakers remained concerned with the low inflation prevailing in the US, as it is still below its 2.0% target.

In other economic news, the seasonally adjusted initial jobless claims declined more-than-expected to 2,63,000 for the week ended 03 October, reaching its 42-year low, from 2,76,000 in the previous week, thus indicating an ongoing tightening in the labour market, despite the recent slowdown in hiring.

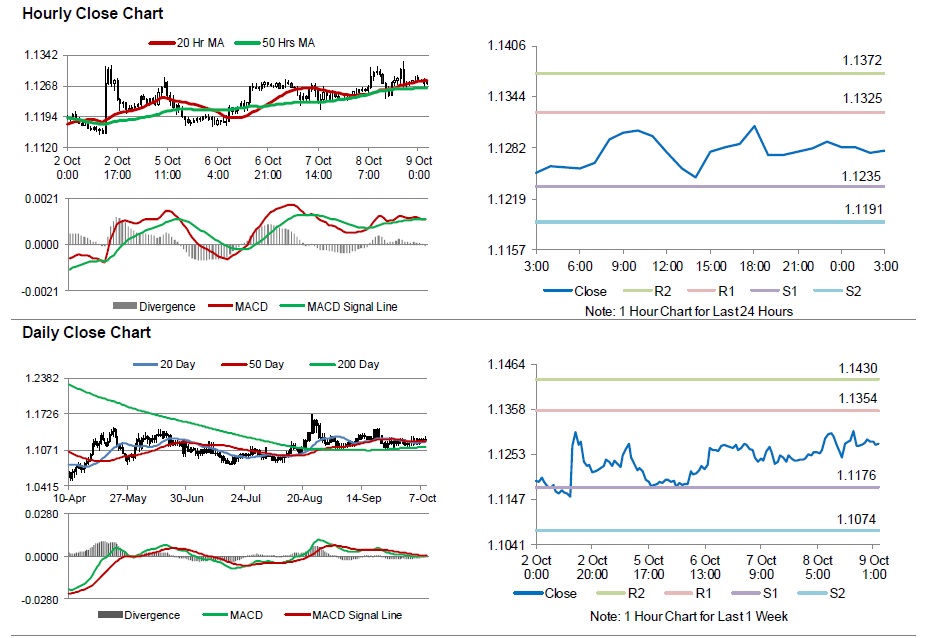

In the Asian session, at GMT0300, the pair is trading at 1.1278, with the EUR trading 0.10% lower from yesterday’s close.

The pair is expected to find support at 1.1235, and a fall through could take it to the next support level of 1.1191. The pair is expected to find its first resistance at 1.1325, and a rise through could take it to the next resistance level of 1.1372.

Going ahead, investors will look forward to the US wholesale inventories and trade sales data, both for the month of August, to be released later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.