For the 24 hours to 23:00 GMT, the GBP fell 0.28% against the USD and closed at 1.5434.

In economic news, UK’s Rightmove house price index rose 0.6% MoM in October, from an increase of 0.9% in the previous month.

Separately, Kristin Forbes, a member of the BoE’s rate-setting monetary policy committee, stated that an interest rate hike in the UK should come “sooner rather than later”. She further argued that slowdown in China and other emerging economies would not be an obstruction for the central bank to raise interest rates.

In the Asian session, at GMT0300, the pair is trading at 1.5438, with the GBP trading marginally higher from Friday’s close.

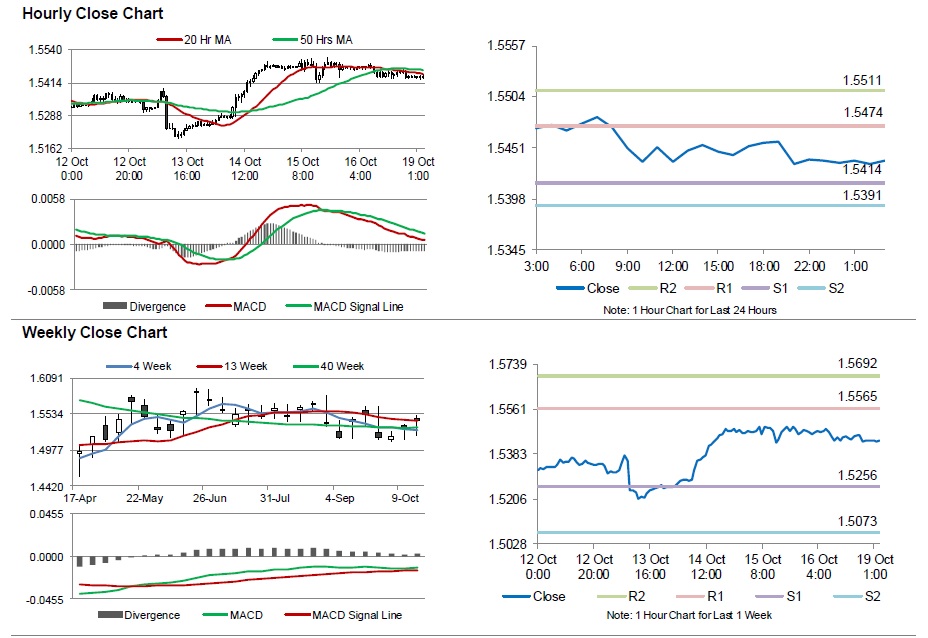

The pair is expected to find support at 1.5414, and a fall through could take it to the next support level of 1.5391. The pair is expected to find its first resistance at 1.5474, and a rise through could take it to the next resistance level of 1.5511.

Going ahead, market participants will look forward to Britain’s public sector net borrowing and retail sales data, scheduled to be released this week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.