For the 24 hours to 23:00 GMT, the GBP fell 0.18% against the USD and closed at 1.5418.

In economic news, UK’s public sector net borrowing reported a surplus of £8.6 billion in September, against investor expectations for a surplus £9.6 billion and compared to an upwardly revised surplus of £10.8 billion in the prior month.

Separately, the BoE Governor, Mark Carney, stated that Britain has been the leading beneficiary of the EU’s single market and the membership has helped lift the nation’s growth and living standards, while also enhanced UK’s flexible labour market and dynamism. However, he was quick to add that closer Euro-zone integration could threaten UK’s financial stability and officials need to safeguard the interest of non-members.

In the Asian session, at GMT0300, the pair is trading at 1.5434, with the GBP trading 0.1% higher from yesterday’s close.

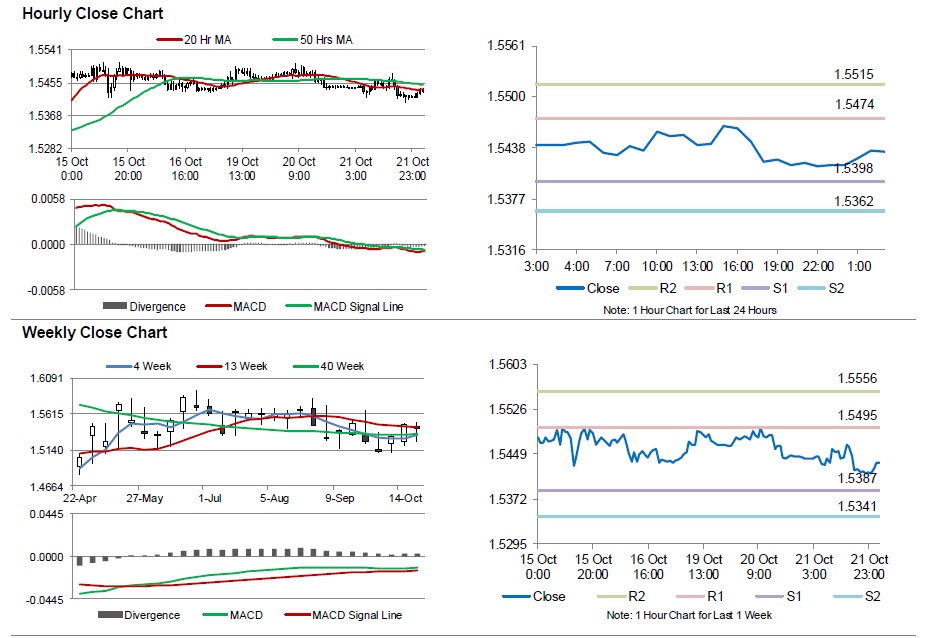

The pair is expected to find support at 1.5398, and a fall through could take it to the next support level of 1.5362. The pair is expected to find its first resistance at 1.5474, and a rise through could take it to the next resistance level of 1.5515.

Going ahead, market participants will closely watch Britain’s retail sales data for September, scheduled to be released in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.