For the 24 hours to 23:00 GMT, EUR declined 0.53% against the USD and closed at 1.4343, following German media reports that the International Monetary Fund would not pay its share of aid to Greece at the end of June. Euro remained under pressure, after Moody’s Investors Service cut Greece’s credit rating by three more notches into junk territory and signaled further downgrades could come. Moody’s downgraded Greece’s ratings to Caa1, seven notches into junk territory, from B1.

In the US, the Automatic Data Processing (ADP) reported that the private sector employment increased by 38,000 jobs in May, following a downwardly revised increase of 177,000 jobs in April. Additionally, the ISM manufacturing index declined to 53.5 in May compared to 60.4 in April.

In the Euro zone, the manufacturing purchasing manager index declined to 54.6 in May from 58.0 in April. On a seasonally adjusted basis, the final manufacturing PMI in Germany declined to a reading of 57.7 in May, the lowest level in seven months, compared to a reading of 62.0 recorded in the previous month.

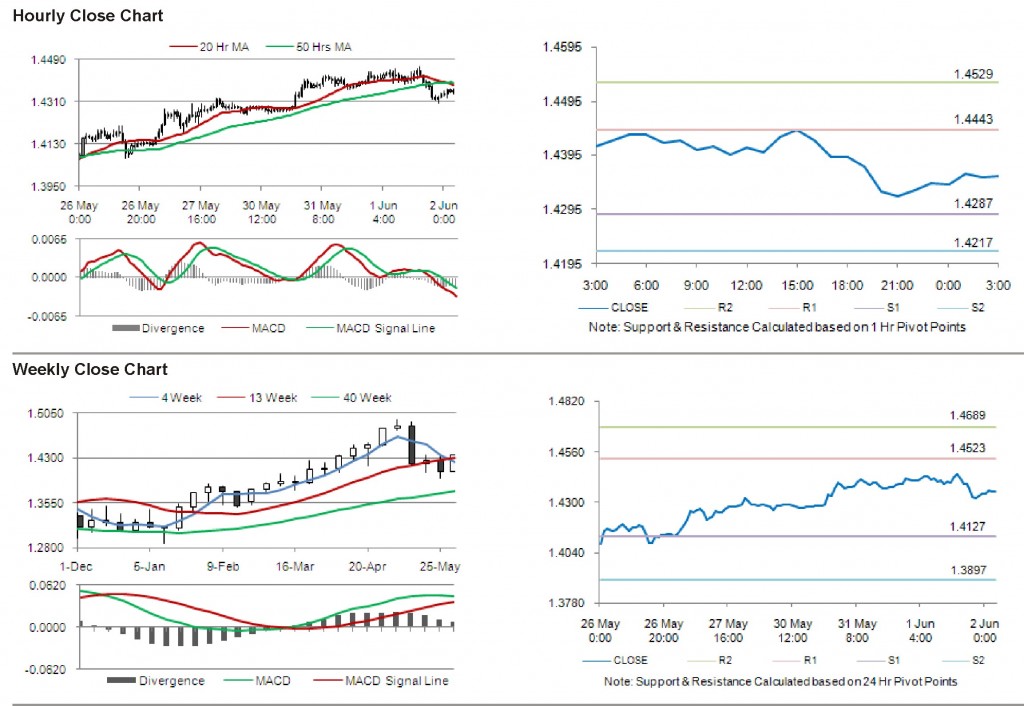

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4356, 0.09% higher from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4443, followed by the next resistance at 1.4529. The first support is at 1.4287 with the subsequent support at 1.4217.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.