For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.1038.

Yesterday, the ECB’s Governing Council member, Ewald Nowotny, stated that monetary policy alone can’t combat deflation and that active fiscal and structural policies are required to increase demand. He further added that the Euro-zone was currently facing a very low inflation situation and is expected to continue that way for some time.

Elsewhere, the ECB’s Executive Board member, Benoit Coeure, mentioned that additional measures are required to increase prices and boost inflation in the Euro-zone.

In the US, durable goods orders dropped 1.2% in September, lower than market expectations for a drop of 1.5%. In the previous month, durable goods orders had registered a downwardly revised drop of 3.0%. Meanwhile, the S&P/Case-Shiller composite home price index of 20 metropolitan areas rose less-than-expected by 5.1% YoY in August, after advancing by a revised 4.9% in July.

Moreover, the flash Markit services PMI eased unexpectedly to a reading of 54.4 in October, compared to market expectations of an advance to a level of 55.5. In the previous month, Markit services PMI had registered a reading of 55.1. Also, the CB consumer confidence index fell to a level of 97.6 in October, lower than market expectations of an advance to 102.9. The index had registered a revised reading of 102.6 in the previous month.

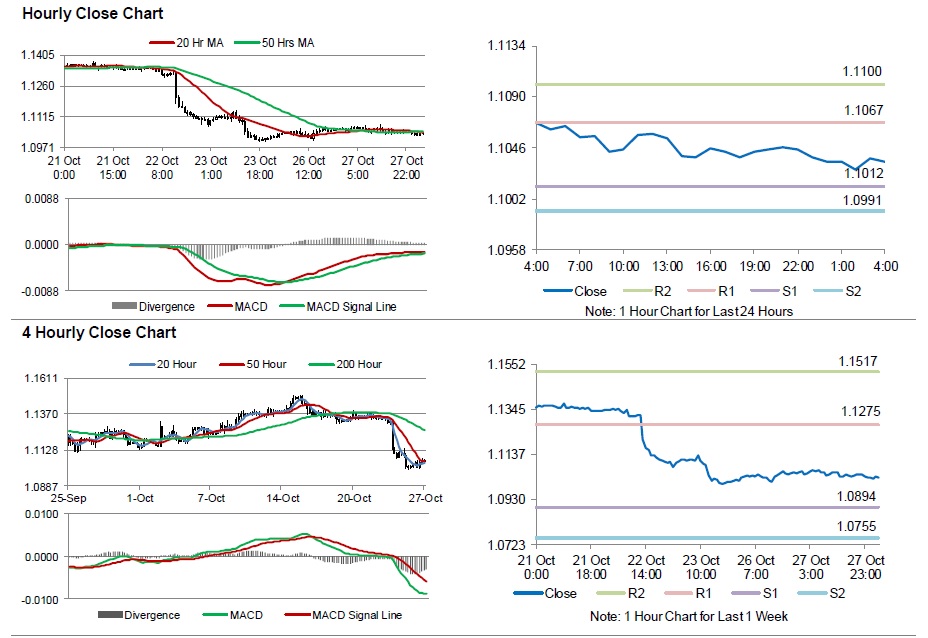

In the Asian session, at GMT0400, the pair is trading at 1.1034, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1012, and a fall through could take it to the next support level of 1.0991. The pair is expected to find its first resistance at 1.1067, and a rise through could take it to the next resistance level of 1.1100.

Going ahead, market participants will look forward to the release of consumer confidence data across the Euro-zone, scheduled in a few hours. Additionally, investors would also focus on the Federal Reserve’s crucial interest rate decision, scheduled later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.