For the 24 hours to 23:00 GMT, the AUD weakened 0.71% against the USD to close at 0.7194.

LME Copper prices declined 0.26% or $13.5/MT to $5219.5/MT. Aluminium prices declined 0.95% or $14.0/MT to $1454.0/MT.

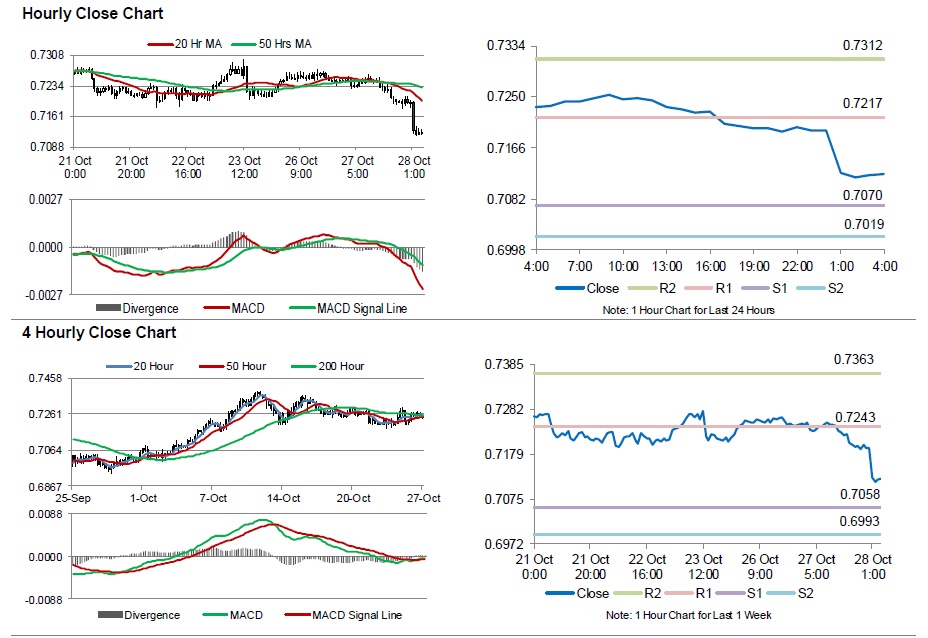

In the Asian session, at GMT0400, the pair is trading at 0.7122, with the AUD trading 1.0% lower from yesterday’s close.

Early morning data showed that Australia’s consumer price index (CPI) rose less-than-expected by 0.5% in 3Q 2015, on QoQ basis, compared to a rise of 0.7% in the prior quarter, thus increasing the likelihood of a rate cut by the RBA. Investors were expecting it to advance by 0.7%. Meanwhile, on an annual basis, the CPI registered a rise of 1.5% in 3Q 2015, compared to a similar rise in the prior quarter. Market anticipation was for the consumer price index to rise 1.7%.

Elsewhere, in China, Australia’s biggest trading partner, the leading index fell to a level of 98.51 in September, from a revised reading of 98.53 in the prior month.

The pair is expected to find support at 0.7070, and a fall through could take it to the next support level of 0.7019. The pair is expected to find its first resistance at 0.7217, and a rise through could take it to the next resistance level of 0.7312.

Going ahead, market participants will look forward to Australia’s HIA new home sales data for September, scheduled to be released early morning tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.