Crude Oil prices declined 1.14% against the USD for the 24 hour period ending 23:00GMT, closing at 43.38, over persistent concerns of a global oil supply glut.

Oil prices remained under pressure, after the American Petroleum Institute (API) reported that US crude oil inventory increased by 4.1 million barrels in the week ended 23 October.

Separately, the US congressional leaders were likely to sell 58.0 million barrels of oil from US emergency reserves in order to pay for a budget deal. However, this would happen only between fiscal years 2018 and 2025.

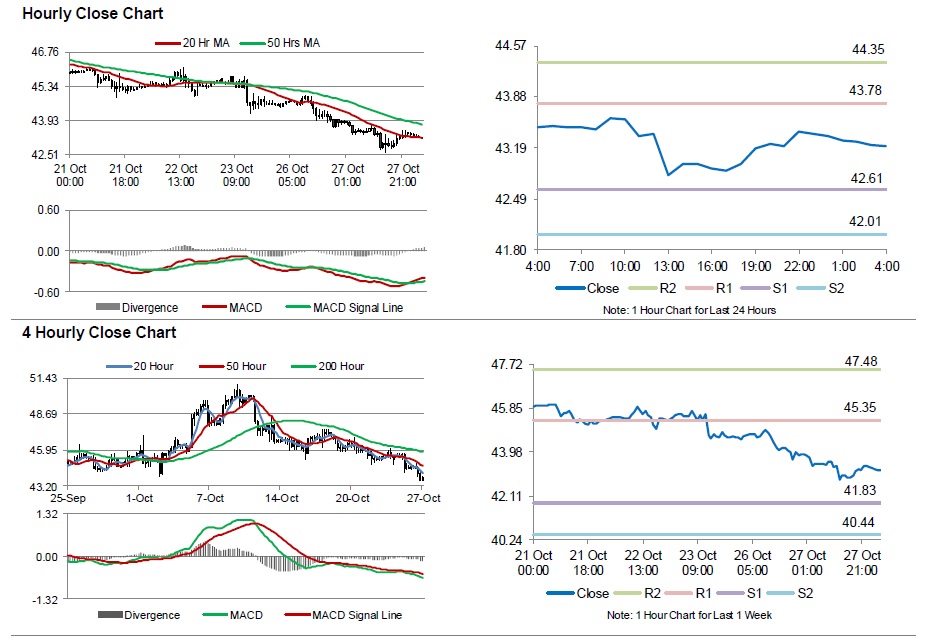

In the Asian session, at GMT0400, the pair is trading at 43.21, with the oil trading 0.39% lower from yesterday’s close.

The pair is expected to find support at 42.61, and a fall through could take it to the next support level of 42.01. The pair is expected to find its first resistance at 43.78, and a rise through could take it to the next resistance level of 44.35.

Crude oil is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.