For the 24 hours to 23:00 GMT, the EUR declined 0.49% against the USD and closed at 1.0879.

In economic news, Euro-zone’s preliminary Markit manufacturing PMI exceeded investor expectations and rose to a 20-month high level of 53.1 in December, compared to a reading of 52.8 in the previous month, while investors were expecting it to record an unchanged reading. Additionally, the flash manufacturing PMI in Germany surprisingly advanced to reach a four month high reading of 53.0 in December, compared to market expectations of a drop to a level of 52.8. It had recorded a reading of 52.9 in the previous month. Meanwhile, the Euro-zone consumer price inflation fell at a less-than-expected pace by 0.1% on a monthly basis in November, following a rise of 0.1% in the previous month and compared to investor expectations for it to fall by 0.2%.

The greenback gained ground, after the US Federal Reserve raised short term interest rates for the first time in almost a decade. The Fed raised the target range for the federal funds rate from 0.0% to 0.25%, putting to end a lengthy debate about whether the US economy was strong enough to withstand higher borrowing costs. Further, the Fed Chairperson, Janet Yellen at a press conference post the interest rate decision stated that the central bank would move gradually in raising rates in the future.

On the macroeconomic front, the US preliminary Markit manufacturing PMI fell more-than expected to a 3-year low level of 51.3 in December, compared to a reading of 52.8 in the previous month. Moreover, the nation’s industrial production dropped for the third straight month by 0.6% in November, more than market expectations for a fall of 0.2%, after declining by a revised 0.4% in the previous month. On the other hand, housing starts in the US rose more-than-expected by 10.5% MoM in November to an annual rate of 1173.0K, compared to market expectations of 1130.0K. Housing starts had recorded a revised level of 1062.0K in the prior month.

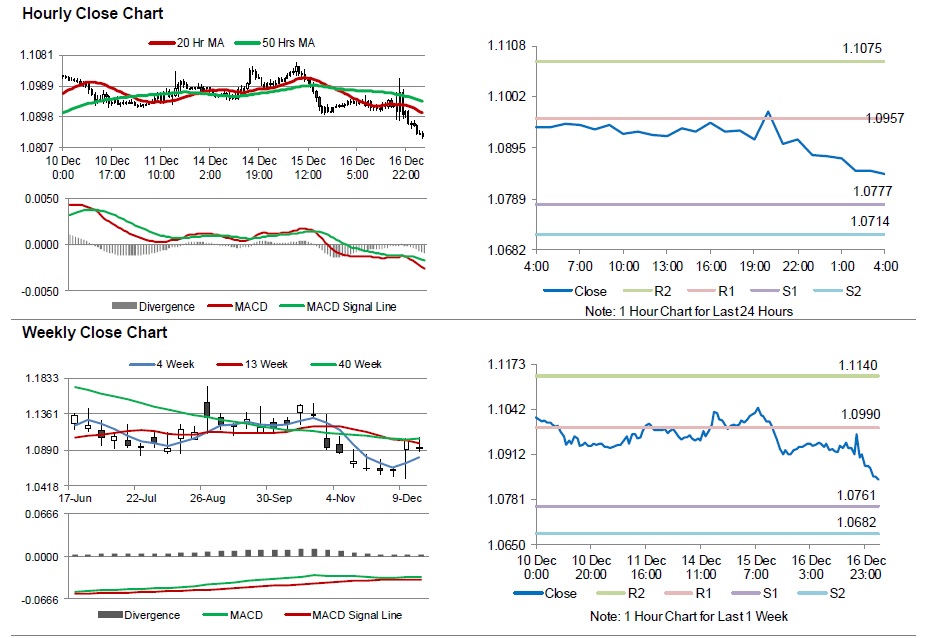

In the Asian session, at GMT0400, the pair is trading at 1.084, with the EUR trading 0.36% lower from yesterday’s close.

The pair is expected to find support at 1.0777, and a fall through could take it to the next support level of 1.0714. The pair is expected to find its first resistance at 1.0957, and a rise through could take it to the next resistance level of 1.1075.

Moving ahead, market participants will look forward to Germany’s IFO expectations and the ECB’s economic bulletin, scheduled to be released in a few hours. Additionally, the US initial jobless claims and the Philadelphia Fed manufacturing survey data for December, due later today, will also be closely watched by investors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.