For the 24 hours to 23:00 GMT, the USD strengthened 0.17% against the JPY and closed at 122.59.

In the Asian session, at GMT0400, the pair is trading at 122.43, with the USD trading 0.13% lower from yesterday’s close.

Early this morning, the BoJ maintained its target of annual asset purchases at around ¥80 trillion and unveiled a new program to purchase ETF’s at an annual pace of about ¥300 billion. Further, the central bank also stated that it would extend the average remaining maturity of Japanese government bonds to 7-12 years from the earlier 7-10 year time period.

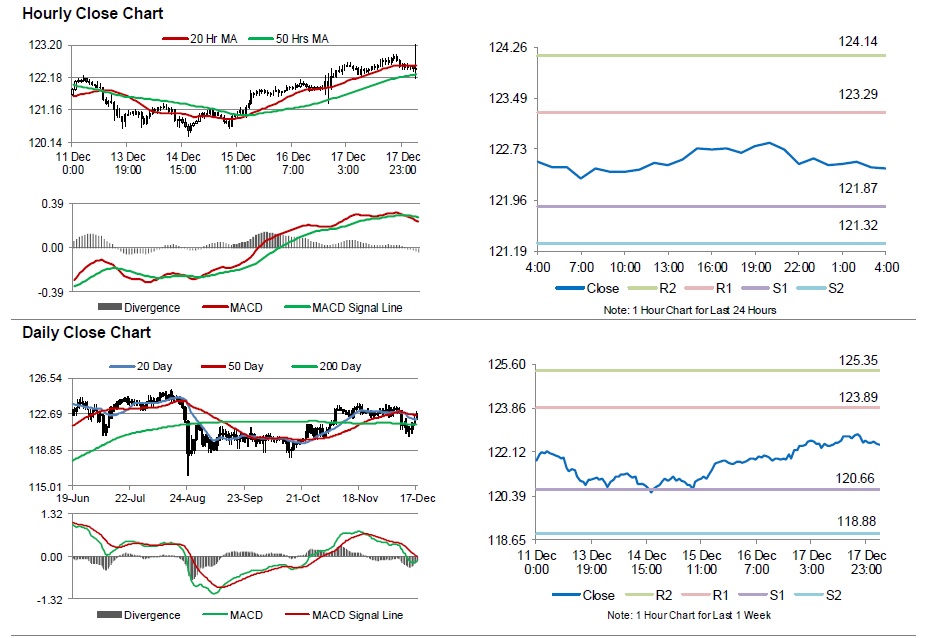

The pair is expected to find support at 121.87, and a fall through could take it to the next support level of 121.32. The pair is expected to find its first resistance at 123.29, and a rise through could take it to the next resistance level of 124.14.

Going ahead, investors will look forward to Japan’s unemployment rate, national consumer price inflation data and the BoJ’s monetary policy meeting minutes, all scheduled to be released next week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.