For the 24 hours to 23:00 GMT, the EUR rose 0.36% against the USD and closed at 1.0951, after the German consumer confidence index marginally improved, notching its first increase in five months.

Data showed that Germany’s GfK consumer confidence index slightly increased to 9.4 in January, from 9.8 recorded in the previous month and beating market expectations of an unchanged reading. Meanwhile, the nation’s producer price index (PPI) slid 0.2% MoM in November, in line with market expectations and following a decline of 0.3% in the previous month.

The greenback lost ground, after the final estimate showed that the US annualized economy expanded 2.0% in 3Q, following an increase of 2.1% reported last month, thus indicating the continuing sluggish economic recovery in the world’s biggest economy. However, markets had estimated that third-quarter GDP growth would be revised down to 1.9%.

Other economic data showed that existing home sales in the nation sharply dipped 10.5% to a level of 4.76 million on a monthly basis in November, marking its weakest pace in 19 months. Existing home sales had registered a revised reading of 5.32 million in the previous month. On the other hand, the US housing price index climbed 0.50% on a MoM basis in October, meeting market expectations. In the previous month, the housing price index had recorded a revised rise of 0.70%.

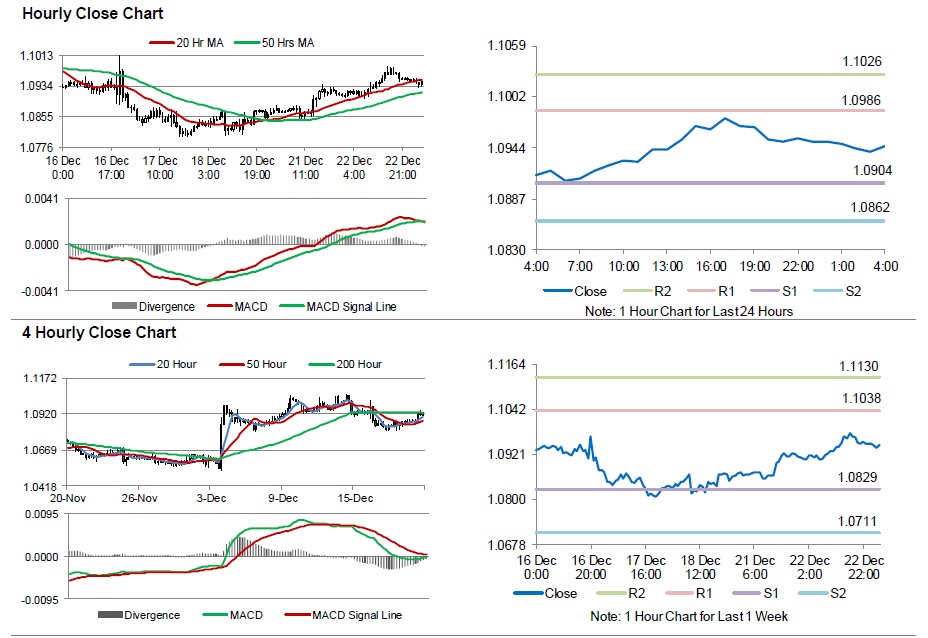

In the Asian session, at GMT0400, the pair is trading at 1.0947, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0904, and a fall through could take it to the next support level of 1.0862. The pair is expected to find its first resistance at 1.0986, and a rise through could take it to the next resistance level of 1.1026.

Trading trends in the Euro today are expected to be determined by the French Q3 GDP data, set for release in a few hours. Meanwhile, the US durable goods orders data, scheduled later today would be on investor’s radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.