For the 24 hours to 23:00 GMT, the GBP fell 0.40% against the USD and closed at 1.4826, after the UK recorded worst public sector net borrowing figures in two years.

Data showed that UK’s public sector net borrowing rose to £13.6 billion in November, from a revised level of £7.5 billion booked in the previous month, while markets had anticipated it to increase to a reading of £11.1 billion.

In the Asian session, at GMT0400, the pair is trading at 1.4834, with the GBP trading marginally higher from yesterday’s close.

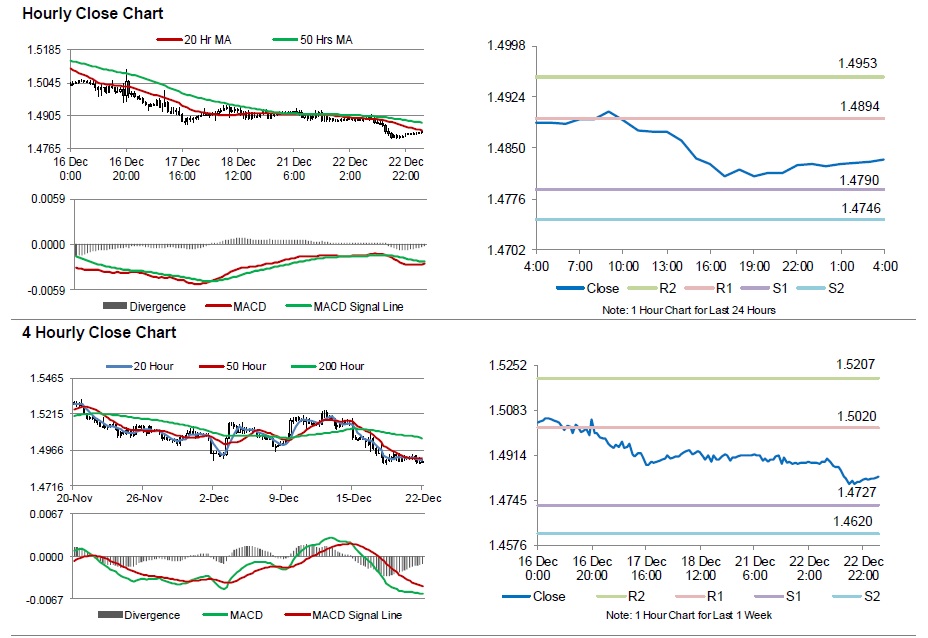

The pair is expected to find support at 1.4790, and a fall through could take it to the next support level of 1.4746. The pair is expected to find its first resistance at 1.4894, and a rise through could take it to the next resistance level of 1.4953.

Looking ahead, Britain’s final estimate of Q3 GDP data, scheduled in a few hours would be closely monitored by investors for further direction in the Pound.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.