For the 24 hours to 23:00 GMT, the EUR declined 0.42% against the USD and closed at 1.0924.

In economic news, Italy’s consumer confidence index dropped for the first time in five months to a level of 117.6 in December, from a reading of 118.4 in the previous month and higher than investor expectations of a fall to a level of 117.0. Moreover, the nation’s business confidence index surprisingly declined to a level of 104.1 during the same month, compared to market expectations for it to remain steady at 104.4.

The greenback gained ground, after the US consumer confidence index rose more-than-expected to a level of 96.5 in December, compared to market expectations of an advance to 93.8 and after registering a revised reading of 92.6 in the previous month. Additionally, the nation’s S&P/Case-Shiller index of 20 metropolitan areas advanced above market expectations by 0.8% on a monthly basis in October, following a revised rise of 0.5% in the previous month and compared to investor expectations of a rise of 0.6%.

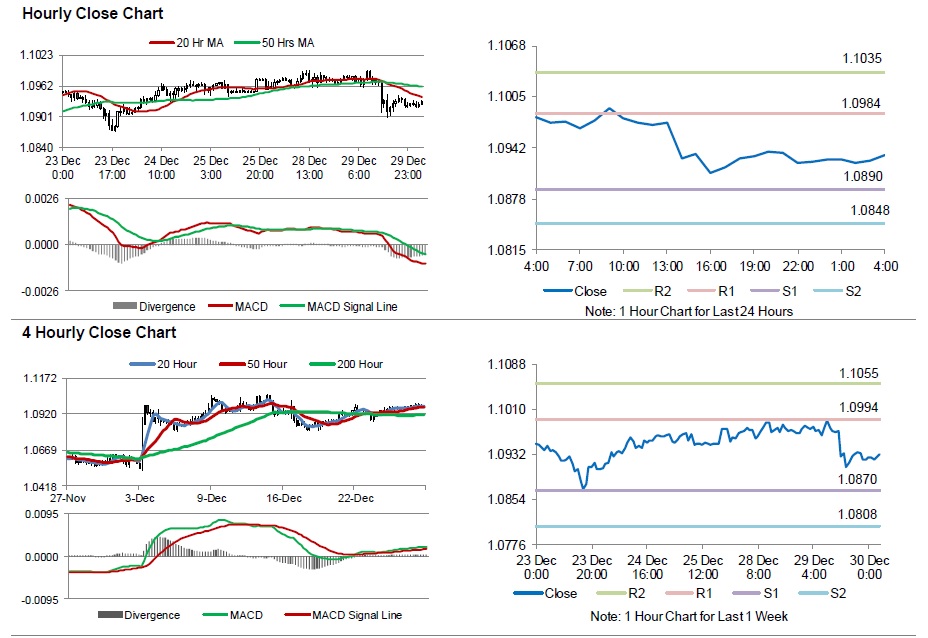

In the Asian session, at GMT0400, the pair is trading at 1.0932, with the EUR trading 0.08% higher from yesterday’s close.

The pair is expected to find support at 1.0890, and a fall through could take it to the next support level of 1.0848. The pair is expected to find its first resistance at 1.0984, and a rise through could take it to the next resistance level of 1.1035.

Going ahead, market participants will look forward to Italy’s producer price index data for November, scheduled to be released in a few hours. Moreover, the US mortgage applications and pending home sales data, due later today, will also attract investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.