For the 24 hours to 23:00 GMT, the EUR declined 0.68% against the USD and closed at 1.0753, after consumer prices in the Euro-zone rose less-than-expected by 0.2% YoY in December, against investor expectations for a growth of 0.4% and following a rise of 0.2% in the previous month, thus adding pressure on the ECB to further loosen its monetary policy. On the other hand, German unemployment rate remained steady at a historic low level of 6.3% in December, cementing its position as the strongest labour market in the Euro-zone.

In the US, the ISM New York business index rose to a level of 62.0 in December, compared to a reading of 60.7 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0746, with the EUR trading 0.07% lower from yesterday’s close.

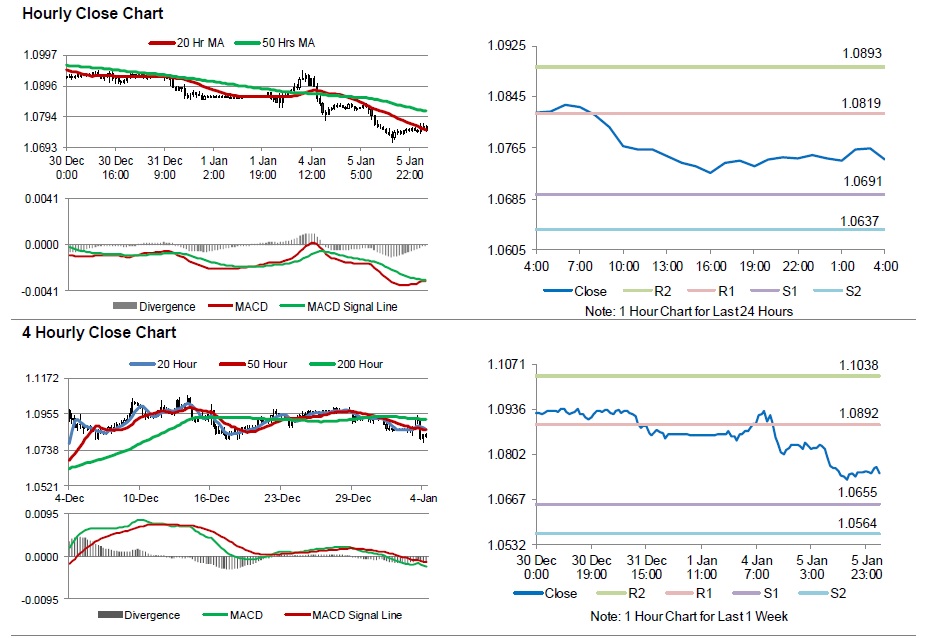

The pair is expected to find support at 1.0691, and a fall through could take it to the next support level of 1.0637. The pair is expected to find its first resistance at 1.0819, and a rise through could take it to the next resistance level of 1.0893.

Going ahead, market participants will look forward to the Markit services PMI data for December across the Euro-zone, scheduled to be released in a few hours. Moreover, the US trade balance, ADP employment change, factory orders, Markit services PMI data and the FOMC December meeting minutes, all scheduled for release later in the day, will also be keenly watched by investors.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.