For the 24 hours to 23:00 GMT, the EUR declined 0.82% against the USD and closed at 1.0872, after the Euro-zone’s Sentix investor confidence index fell more-than-expected to a level of 9.6 in January, compared to market expectations of a fall to a level of 11.4 and after registering a reading of 15.7 in the previous month.

In the US, labour market conditions index rose to a level of 2.9 in December, from a reading of 2.7 in the previous month.

Separately, the US Atlanta Fed President, Dennis Lockhart, stated that there may not be enough data on inflation to support a second interest rate hike in January or March this year. He further mentioned that he remains “mildly optimistic” that strong domestic consumption will enable US to attain a GDP growth of as much as 2.5% in 2016.

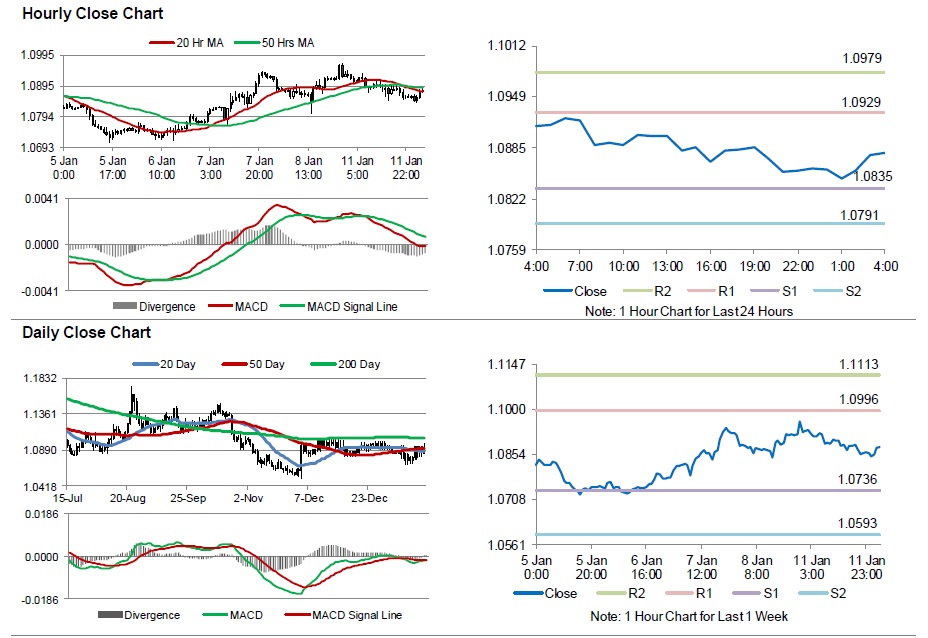

In the Asian session, at GMT0400, the pair is trading at 1.088, with the EUR trading 0.18% higher from yesterday’s close.

The pair is expected to find support at 1.0835, and a fall through could take it to the next support level of 1.0791. The pair is expected to find its first resistance at 1.0929, and a rise through could take it to the next resistance level of 1.0979.

Going ahead, investors will look forward to the US IBD/TIPP economic optimism and NFIB small business optimism indices data, scheduled to release later today.

The currency pair is showing convergence with its 20 Hr moving average is trading below its 50 Hr moving average.