For the 24 hours to 23:00 GMT, the USD rose 0.27% against the CAD to close at 1.4221.

The Canadian dollar lost ground, after Canada’s housing starts declined more-than-expected to a level of 173.0K in December, from a revised reading of 212.0K in the previous month and compared to investor expectations for it to fall to a level of 200.0K.

Separately, the BoC, in its quarterly business outlook survey, indicated that the hiring and investment intentions of Canadian companies have fallen to their lowest levels since the 2009 recession due to sliding oil prices. Further, it mentioned that the country’s business firms continue to battle the problem of falling commodity prices that has reached beyond resource-rich regions and sectors.

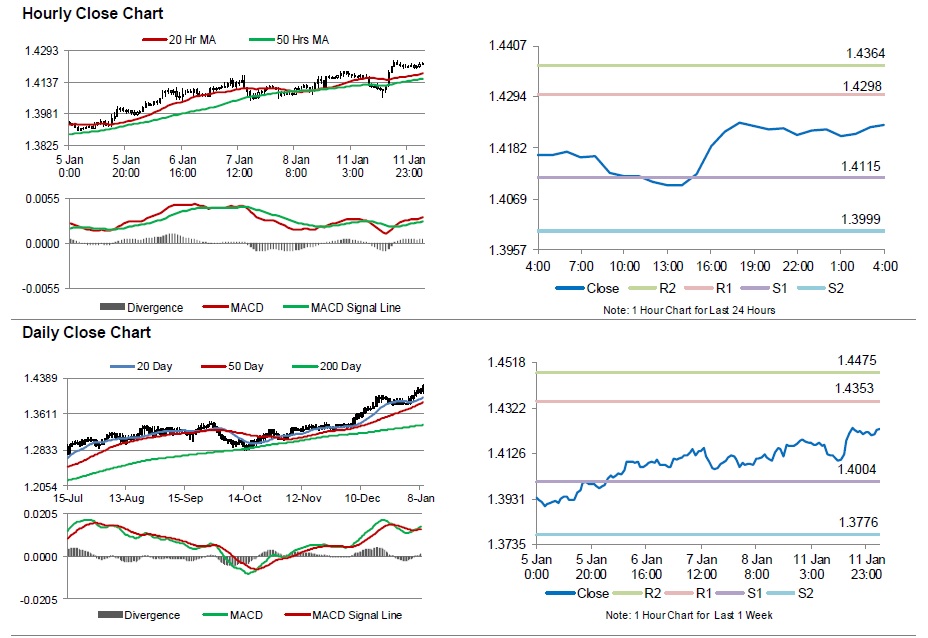

In the Asian session, at GMT0400, the pair is trading at 1.4232, with the USD trading 0.09% higher from yesterday’s close.

The pair is expected to find support at 1.4115, and a fall through could take it to the next support level of 1.3999. The pair is expected to find its first resistance at 1.4298, and a rise through could take it to the next resistance level of 1.4364.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.