For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.0923, after the release of upbeat employment data in the Euro-zone.

Data showed that Euro-zone’s unemployment rate surprisingly fell to 10.4% in December, touching its lowest level since September 2011, while markets expected it to remain steady at 10.5%. Additionally, Germany’s seasonally adjusted unemployment rate unexpectedly dropped to a historic low of 6.2% in January, compared to market expectations for it to remain steady at 6.3%. Moreover, the number of people unemployed declined more-than-anticipated by 20.0K in January, following a revised fall of 16.0K in the previous month and beating investor expectations for a drop of 8.0K.

In the US, the IBD/TIPP economic optimism index rose more-than-expected to a level of 47.8 MoM in February, from a reading of 47.3 in the previous month and compared to market expectations of an increase to a level of 47.6.

Separately, the Kansas City Fed President, Esther George, downplayed effects of the recent financial market volatility and stated that fundamentals of the US economy are strong enough to withstand further rate hikes this year.

In the Asian session, at GMT0400, the pair is trading at 1.0925, with the EUR trading marginally higher from yesterday’s close.

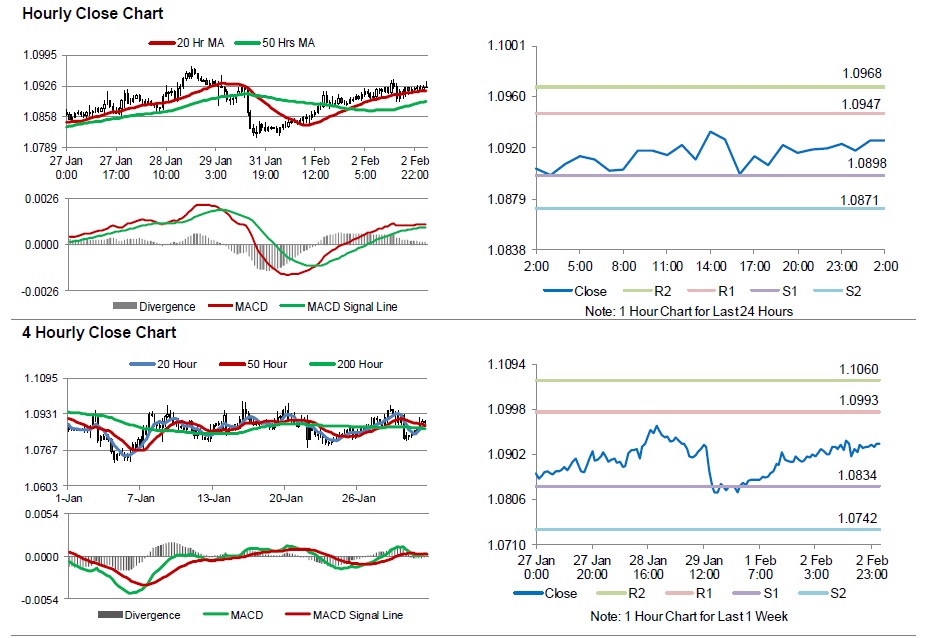

The pair is expected to find support at 1.0898, and a fall through could take it to the next support level of 1.0871. The pair is expected to find its first resistance at 1.0947, and a rise through could take it to the next resistance level of 1.0968.

Moving ahead, investors will look forward to final Markit services PMI data for January, across the Eurozone, slated to be released in a few hours. Additionally, the US final Markit services PMI and mortgage applications data, due later today, will also attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.