For the 24 hours to 23:00 GMT, the EUR declined 0.84% against the USD and closed at 1.1028, after downbeat manufacturing and services PMI data in the Euro-zone.

Data showed that, the Euro-zone’s flash Markit manufacturing PMI fell more-than-anticipated to a level of 51.0 in February, compared to market expectations for a fall to a level of 52.0 and following a reading of 52.3 in the previous month. Additionally, the region’s flash Markit services PMI declined to a thirteen-month low level of 53.0 in February, from to a reading of 53.6 in the previous month and compared to investor consensus for a drop to a level of 53.4, thus indicating that the Euro-zone is already suffering the consequences of global economic downturn.

Elsewhere, in Germany, the region’s largest economy, the preliminary Markit manufacturing PMI dropped to a fifteen-month low level of 50.2 in February, compared to a level of 52.3 in the previous month while market expectation was for it to drop to a level of 51.9. On the other hand, the nation’s services PMI unexpectedly advanced to a level of 55.1 in February, compared to market expectation for a decline to a level of 54.7.

In the US, the preliminary Markit manufacturing PMI unexpectedly fell to a level of 51.0 in February, hitting the lowest level since September 2009, while markets expected it to remain steady at 52.4, thus showing that the nation’s economic growth lost steam this year. Further, the Chicago Fed national activity index surprisingly rebounded to a level of 0.28 in January, after recording a revised reading of -0.34 in the previous month.

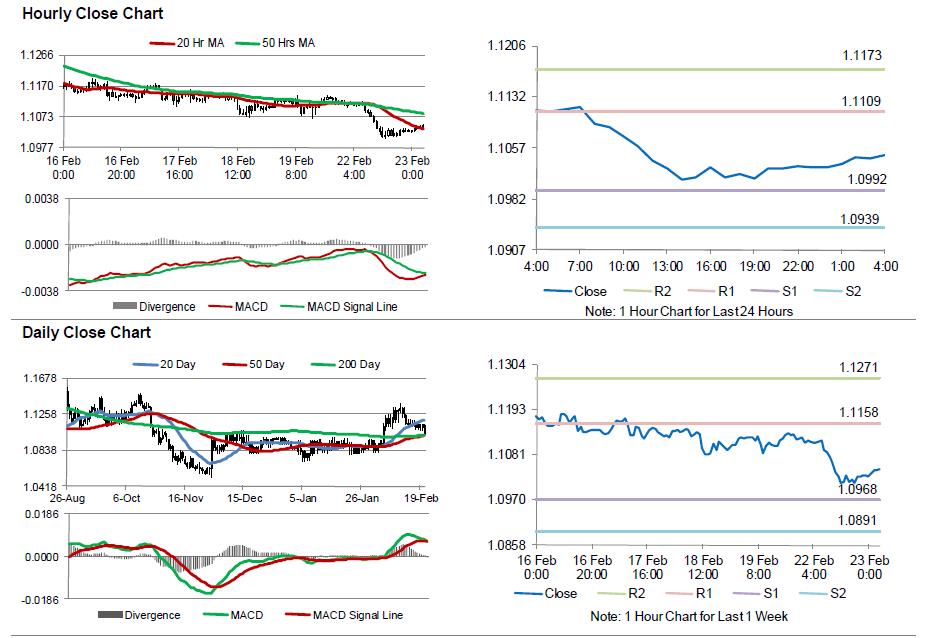

In the Asian session, at GMT0400, the pair is trading at 1.1045, with the EUR trading 0.16% higher from yesterday’s close.

The pair is expected to find support at 1.0992, and a fall through could take it to the next support level of 1.0939. The pair is expected to find its first resistance at 1.1109, and a rise through could take it to the next resistance level of 1.1173.

Moving ahead, investors await the release of Germany’s Q4 GDP and IFO expectations data, slated to be released in a few hours. Additionally, the US consumer confidence index and existing home sales data, scheduled to be released later today, will also be on investor’s radar.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.