For the 24 hours to 23:00 GMT, EUR rose 0.72% against the USD and closed at 1.4684.

The Fed Chairman, Ben Bernanke stated that the US economy would pick up in the second half of the year as the labor market gradually improves, but also admitted that the economic recovery was proving to be “uneven” and “frustratingly slow.”

The US dollar was pressurized after the statement from the Fed Chairman, Ben Bernanke bolstered expectations that the US interest rates would stay low for a longer time.

In the Euro zone, the retail sales, on monthly basis, rose by 0.9% in April, compared to a 0.9% drop in March. In Germany, the factory orders, on a monthly basis, increased by 2.8% in April, following a 2.7% fall recorded in March.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4655, 0.20% lower from the levels yesterday at 23:00GMT.

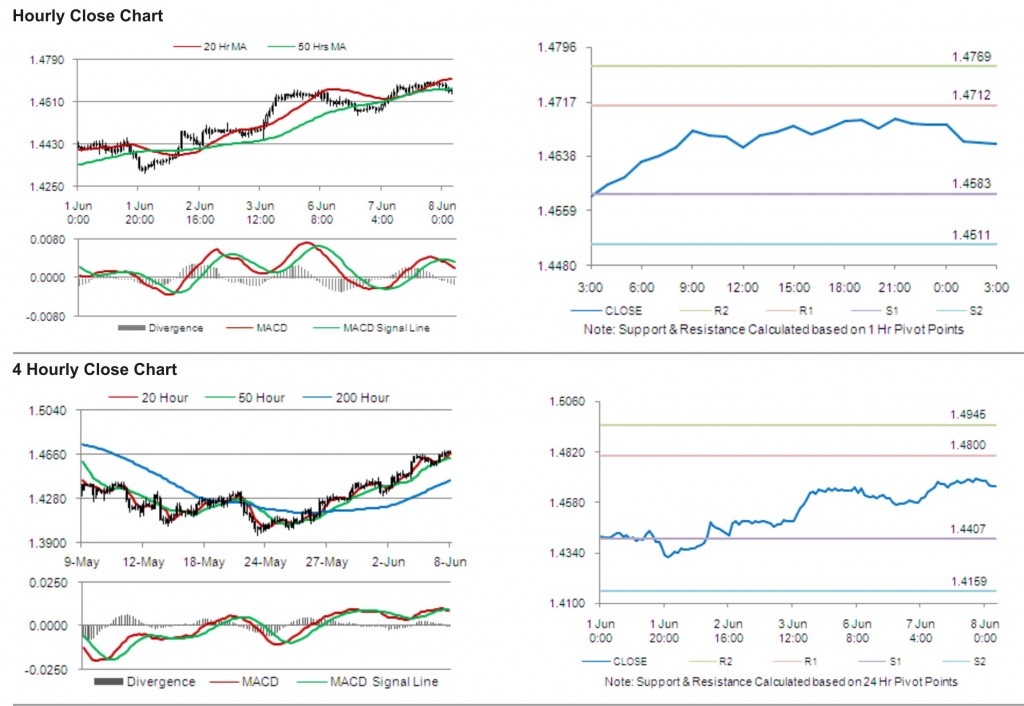

The pair has its first short term resistance at 1.4712, followed by the next resistance at 1.4769. The first support is at 1.4583, with the subsequent support at 1.4511.

Trading trends in the pair today are expected to be determined by release of data on gross domestic product in the Euro zone.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.