For the 24 hours to 23:00 GMT, the USD declined 0.90% against the CAD to close at 1.3223.

In economic news, Canada’s unemployment rate unexpectedly rose to a three-year high level of 7.3% in February, compared to investor expectations for it to remain steady at 7.2%. Moreover, the net number of people employed surprisingly eased by 2.3K in February, compared to a loss of 5.7K in the previous month. Markets were anticipating the net number of people employed to advance by 10.0K.

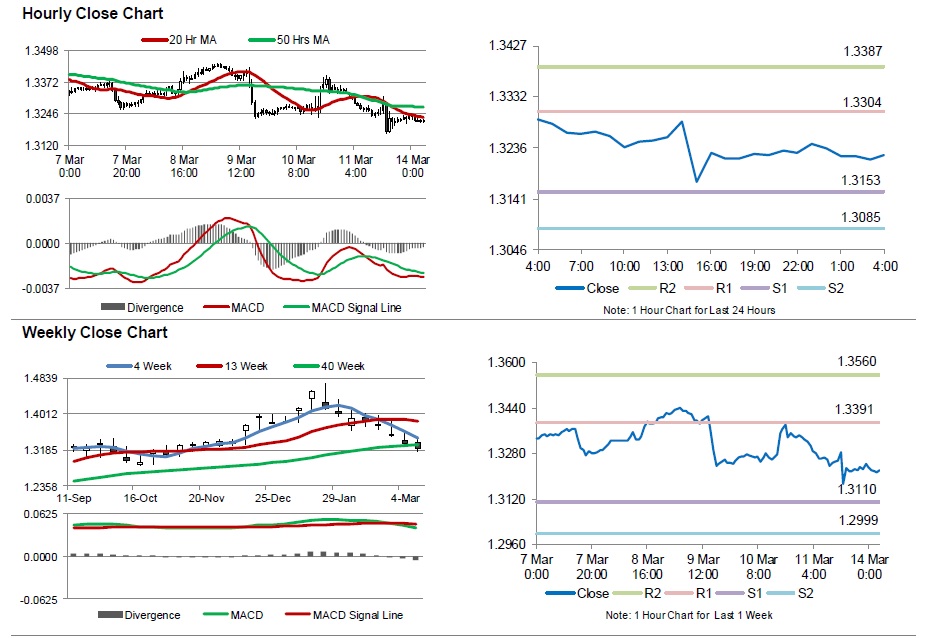

In the Asian session, at GMT0400, the pair is trading at 1.3222, with the USD trading marginally lower from Friday’s close.

The pair is expected to find support at 1.3153, and a fall through could take it to the next support level of 1.3085. The pair is expected to find its first resistance at 1.3304, and a rise through could take it to the next resistance level of 1.3387.

Going ahead, market participants will look forward to Canada’s existing home sales data for February, scheduled to release tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.