For the 24 hours to 23:00 GMT, GBP fell 0.20% against the USD and closed at 1.6365.

The Bank of England’s (BoE) Monetary Policy Committee decided to retain the interest rate at a record low of 0.5%, matching market estimates. The central bank also maintained the size of its quantitative easing at £200.0 billion.

In the UK, the visible trade deficit narrowed to £7.4 billion in April, following a trade deficit of £7.7 billion recorded in March. Meanwhile, on a seasonally adjusted basis, the total deficit on trade in goods and services remained unchanged at £2.8 billion in April from the previous month.

The pair opened the Asian session at 1.6365, and is trading at 1.6363 at 3.00GMT. The pair is trading flat from yesterday’s close at 23:00 GMT.

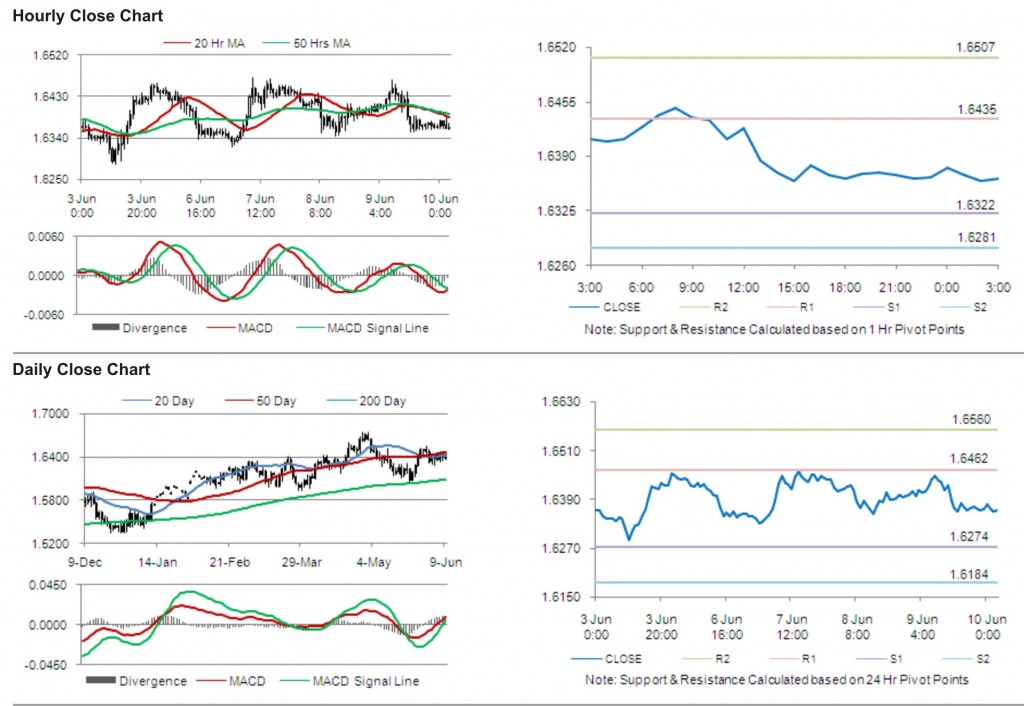

The pair has its first short term resistance at 1.6435, followed by the next resistance at 1.6507. The first support is at 1.6322, with the subsequent support at 1.6281.

With a series of UK economic releases today, including producer price index and industrial production, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.