For the 24 hours to 23:00 GMT, USD weakened 0.04% against the JPY, on Friday, and closed at 80.29, after the Japanese tertiary sector activity rebounded in May.

In Japan, on Friday, the tertiary industry activity index improved to 2.6% (M-o-M) in April, from 5.9% decline in the previous month. Additionally, this morning, the core machinery orders declined by 3.3% in April, from 2.9% increase in March.

In the Asian session at 3:00GMT, the pair is trading higher from Friday’s close at 23:00 GMT, by 0.27%, at 80.51.

Yen was pressured this morning on speculation that the Bank of Japan (BoJ) would introduce more stimulus measures to support economic growth.

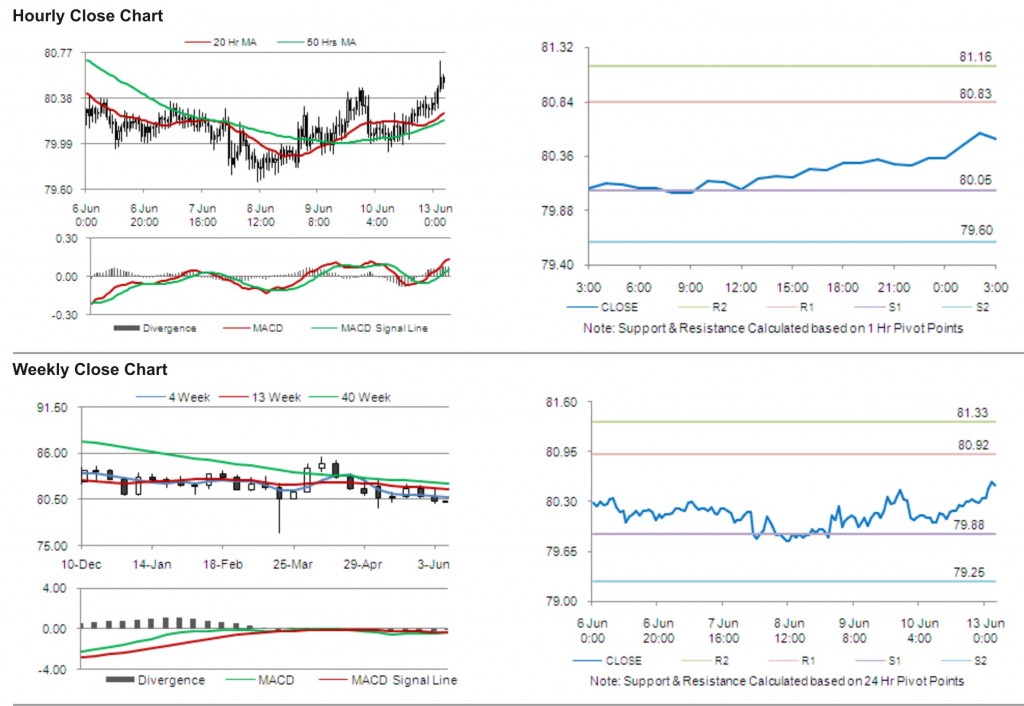

The first short term resistance is at 80.83, followed by 81.16. The pair is expected to find support at 80.05 and the subsequent support level at 79.60.

Investors are awaiting for the release of Bank of Japan monetary policy meeting minutes along with other economic releases in Japan to be released later today.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.