For the 24 hours to 23:00 GMT, the EUR rose 0.27% against the USD and closed at 1.1154.

On the economic front, the US NAHB housing market index climbed to a level of 60.0 in August, at par with market consensus and compared to a revised reading of 58.0 in the previous month. On the other hand, the nation’s New York Empire State manufacturing index unexpectedly fell to a level of -4.21 in August, defying market expectations for an advance to a level of 2.0 and following a reading of 0.55 in the prior month.

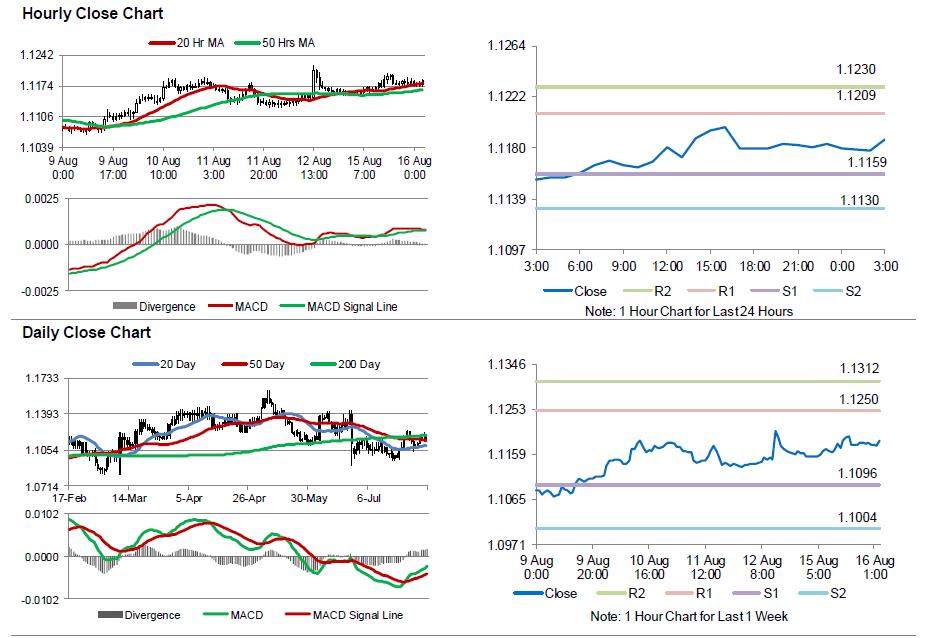

In the Asian session, at GMT0300, the pair is trading at 1.1187, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1159, and a fall through could take it to the next support level of 1.1130. The pair is expected to find its first resistance at 1.1209, and a rise through could take it to the next resistance level of 1.1230.

Going ahead, investors would look forward to the release of ZEW survey for economic sentiment for August across the Euro-zone, due in a few hours. Additionally, this evening will bring some influential data releases from the US, namely the nation’s consumer price inflation, industrial production, manufacturing production, housing starts and building permits.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.