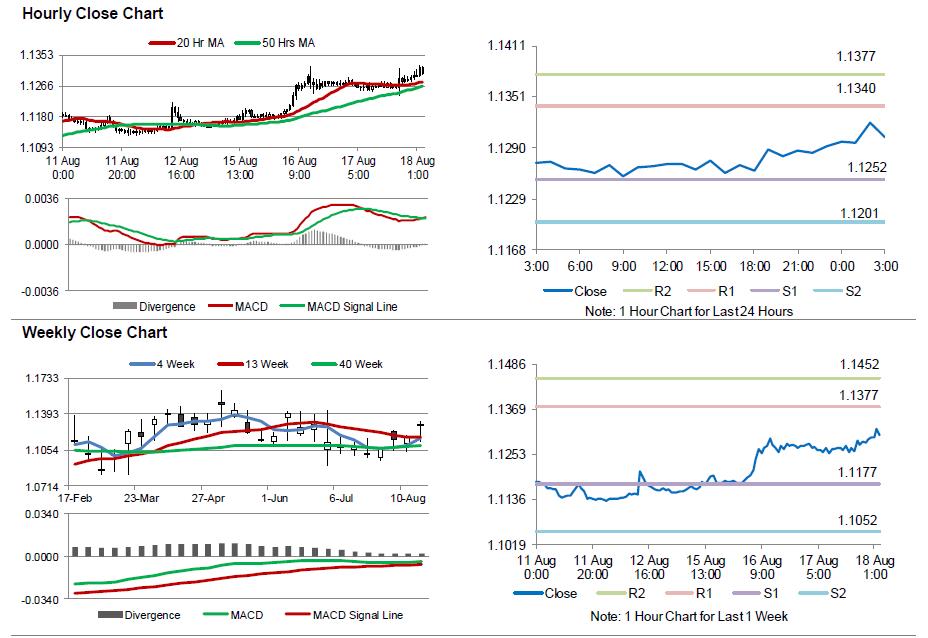

For the 24 hours to 23:00 GMT, the EUR rose 0.15% against the USD and closed at 1.1292.

The greenback lost ground against the major peers, after minutes from the US Federal Reserve’s recent monetary policy meeting shed little light on the timing of next interest rate hike. The minutes suggested that policymakers found it was appropriate to wait for additional information before tightening the monetary policy, while two officials suggested an immediate rate hike is needed. The minutes further indicated that board members were generally upbeat about the nation’s economic outlook and labour market.

In the Asian session, at GMT0300, the pair is trading at 1.1302, with the EUR trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1252, and a fall through could take it to the next support level of 1.1201. The pair is expected to find its first resistance at 1.1340, and a rise through could take it to the next resistance level of 1.1377.

Investors would now await the release of Euro-zone’s consumer price index data for July along with the ECB’s monetary policy meeting accounts. Moreover, in the US, initial jobless claims, the Philadelphia Fed index and CB leading indicators data, all due later in the day, would garner significant market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.