For the 24 hours to 23:00 GMT, the AUD strengthened 0.18% against the USD to close at 0.7583.

LME Copper prices declined 0.09% or $4.0/MT to $4603.0/MT. Aluminium prices declined 1.48% or $23.5/MT to $1568.5/MT.

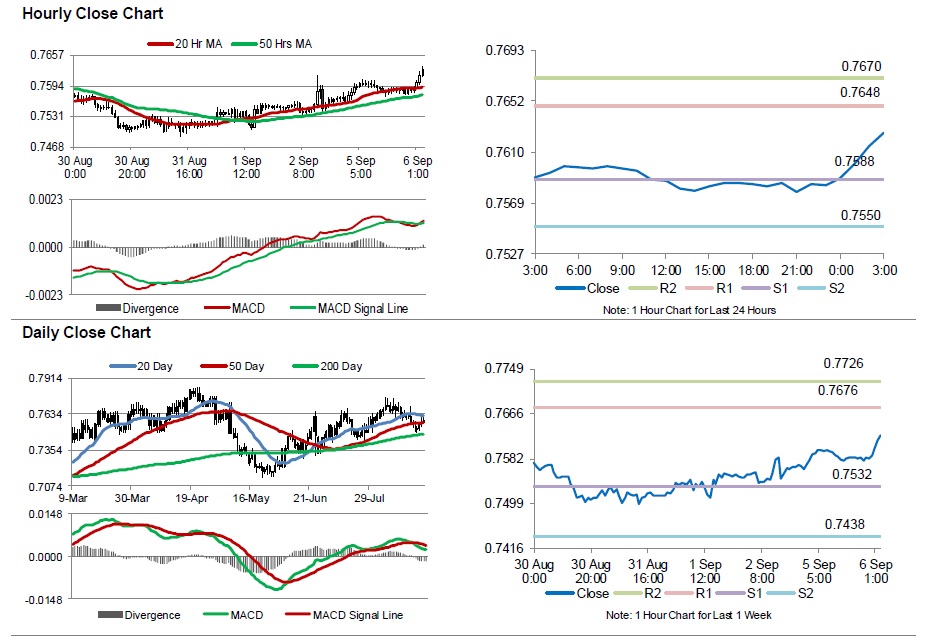

In the Asian session, at GMT0300, the pair is trading at 0.7626, with the AUD trading 0.57% higher against the USD from yesterday’s close.

Early this morning, the Reserve Bank of Australia (RBA) held official cash rate steady at 1.5%, as widely expected, citing signs of continued growth in Australia, despite global headwinds. The RBA’s official statement further mentioned that the nation’s labour market indicators continue to be mixed, but suggest continued expansion in employment during the near term.

In other economic news, Australia’s current account deficit widened to A$15.5 billion in 2Q 2016, following a revised current account deficit of A$14.9 billion in the previous quarter.

The pair is expected to find support at 0.7588, and a fall through could take it to the next support level of 0.7550. The pair is expected to find its first resistance at 0.7648, and a rise through could take it to the next resistance level of 0.7670.

Going ahead, investors look forward to Australia’s AiG performance of construction index for August, scheduled to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.