For the 24 hours to 23:00 GMT, USD rose 1.00% against the CAD to close at 0.9783.

Canadian dollar declined following weaker Canadian and the US economic data and amid renewed concerns that the Greek debt crisis could escalate.

In the US, the net long-term capital inflow rose to $30.6 billion in April, compared to a total capital inflow of $24.0 billion recorded in the previous month. Meanwhile, foreign capital into the US treasury fell $3.4 billion to $23.3 billion in April, the fifth consecutive monthly decline. Additionally, the consumer price inflation, on a monthly basis, declined to 0.2% in May, following a rate of 0.4% recorded in April.

In Canada, the manufacturing sales, on a monthly basis, declined by 1.3% in April, compared to the 1.9% rise recorded in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 0.9788, 0.05% higher from yesterday’s close at 23:00 GMT.

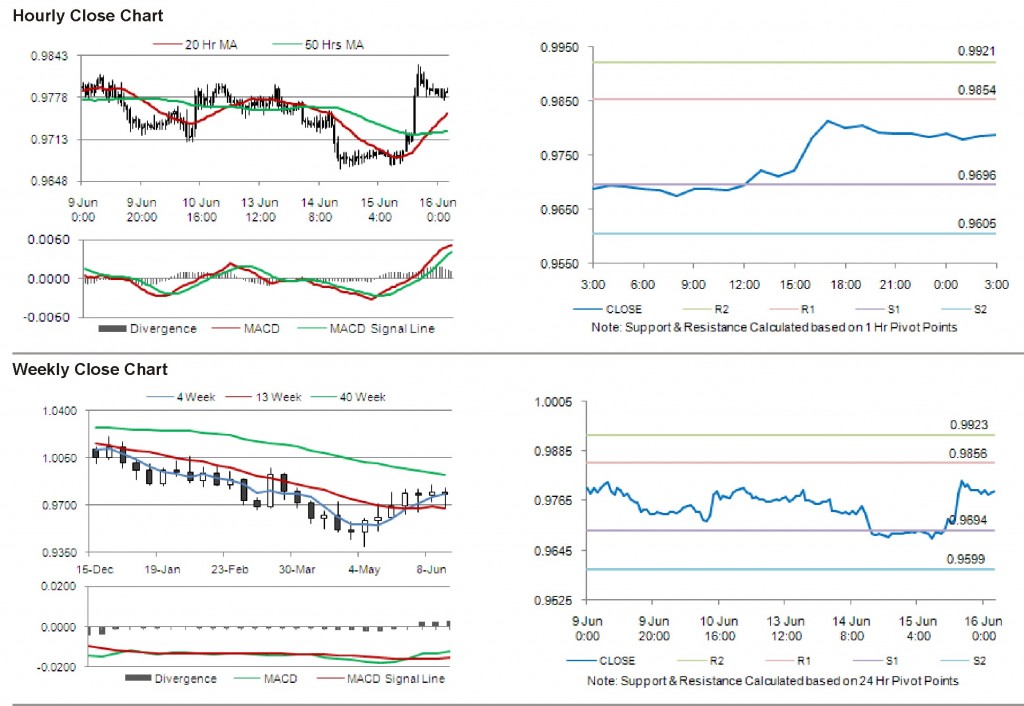

The first area of short term resistance is observed at 0.9854, followed by 0.9921 and 1.0079. The first area of support is at 0.9696, with the subsequent supports at 0.9605 and 0.9447.

Trading trends in the pair today are expected to be determined by data release on foreign investment in Canadian securities.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.