For the 24 hours to 23:00 GMT, the AUD strengthened 0.33% against the USD to close at 0.7559.

Yesterday, the Reserve Bank of Australia’s Assistant Governor, Christopher Kent, provided an optimistic assessment of the Australian economy and stated that recent economic growth has been stronger than what the central bank had expected. He also indicated that prospects for a pickup in wages growth and inflation look good.

LME Copper prices declined 1.07% or $49.5/MT to $4573.0/MT. Aluminium prices declined 1.40% or $22.0/MT to $1545.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7543, with the AUD trading 0.21% lower against the USD from yesterday’s close.

Early this morning, data showed that Australia’s NAB business confidence index rose to a level of 6.0 in August, from a reading of 4.0 in the previous month. On the other hand, the nation’s NAB business conditions index eased to a level of 7.0 in August, compared to a reading of 9.0 in the previous month.

Meanwhile in China, Australia’s largest trading partner, retail sales advanced more-than-anticipated by 10.6% YoY in August, from a 10.2% gain in the previous month. Also, the nation’s industrial production rose above expectations by 6.3% YoY in August, its fastest increase in five months, after rising by 6.0% in the previous month.

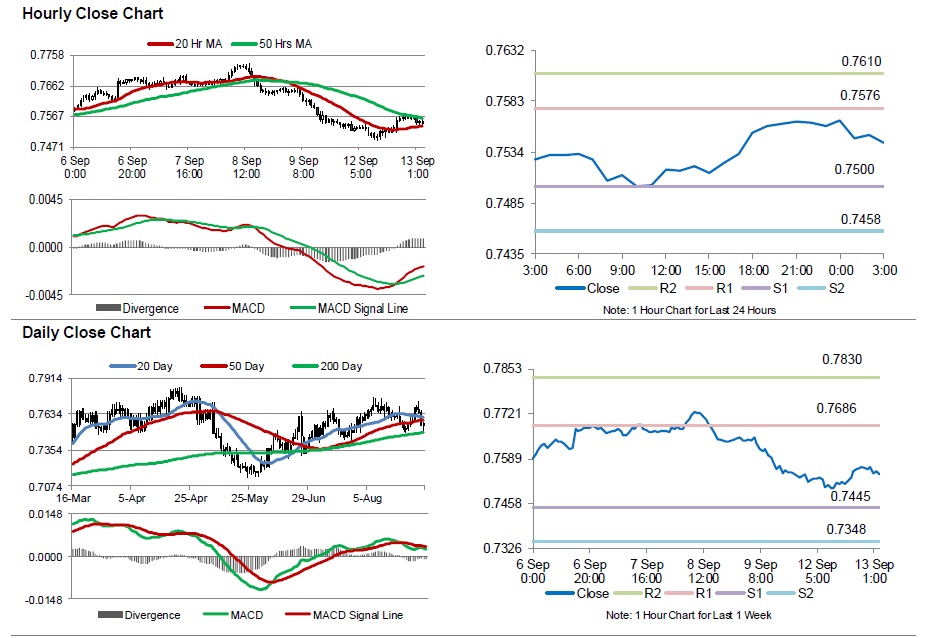

The pair is expected to find support at 0.7500, and a fall through could take it to the next support level of 0.7458. The pair is expected to find its first resistance at 0.7576, and a rise through could take it to the next resistance level of 0.7610.

Going ahead, investors await the release of Australia’s Westpac consumer confidence index for September, due in the early hours tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.