For the 24 hours to 23:00 GMT, USD weakened 0.32% against the JPY and closed at 80.60.

In Japan, minutes from the Bank of Japan’s (BoJ) monetary policy meeting showed that the need for additional easing measures remains potentially strong. At the meeting, the board unanimously decided to leave the uncollateralized overnight call rate unchanged at around 0 to 0.1% by a unanimous vote. The central bank also maintained its ¥10-trillion asset purchase program.

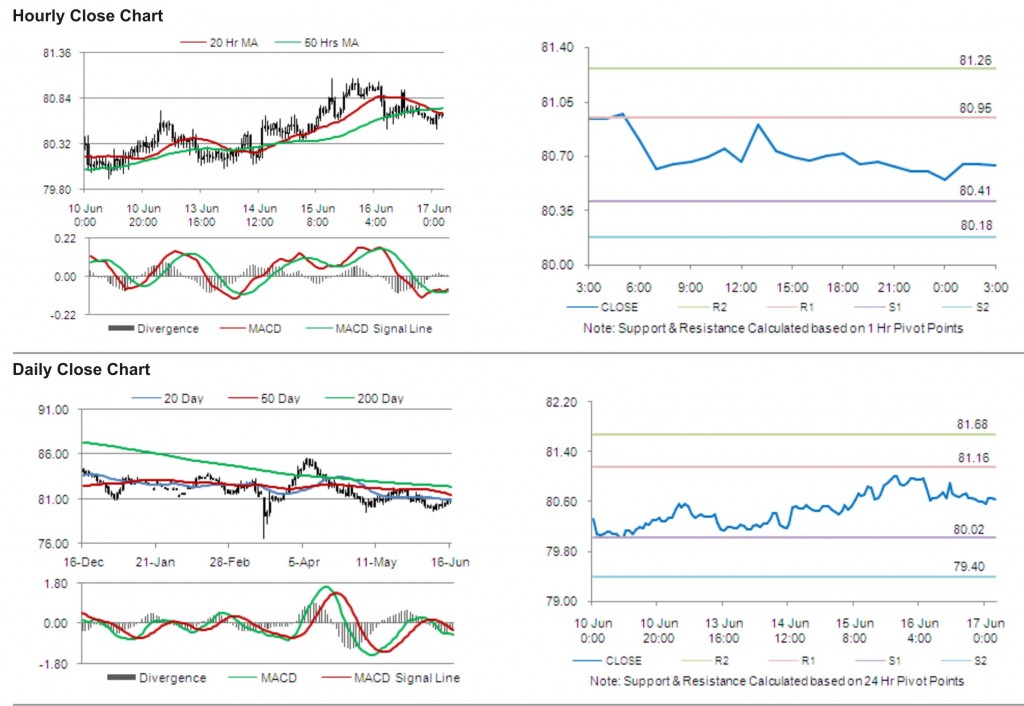

In the Asian session at 3:00GMT, the pair is trading higher from yesterday’s close at 23:00 GMT, by 0.05%, at 80.64.

The first short term resistance is at 80.95, followed by 81.26. The pair is expected to find support at 80.41 and the subsequent support level at 80.18.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.