For the 24 hours to 23:00 GMT, the AUD declined 0.12% against the USD and closed at 0.7554.

Yesterday, the Reserve Bank of Australia’s (RBA) Governor, Philip Lowe, maintained a generally optimistic tone about the nation’s economic growth. Further, he added that there were reasonable prospects that inflation would return to around the average levels over the next couple of years.

LME Copper prices declined 3.06% or $172.0/MT to $5448.0/MT. Aluminium prices declined 2.15% or $38.0/MT to $1727.0/MT.

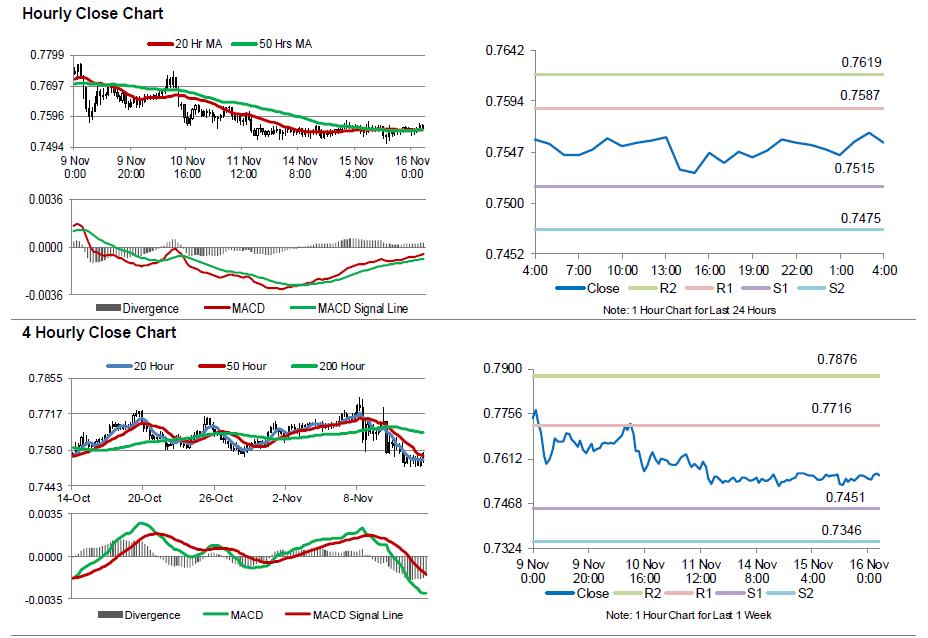

In the Asian session, at GMT0400, the pair is trading at 0.7556, with the AUD trading marginally higher against the USD from yesterday’s close.

Overnight data revealed that, Australia’s Westpac leading index climbed by 0.06% on a monthly basis in October. In the previous month, the Westpac leading index had registered a revised rise of 0.08%.

The pair is expected to find support at 0.7515, and a fall through could take it to the next support level of 0.7475. The pair is expected to find its first resistance at 0.7587, and a rise through could take it to the next resistance level of 0.7619.

Moving ahead, investors would closely monitor Australia’s unemployment rate for October, scheduled to release overnight, to get better insights into the Australian economy.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.