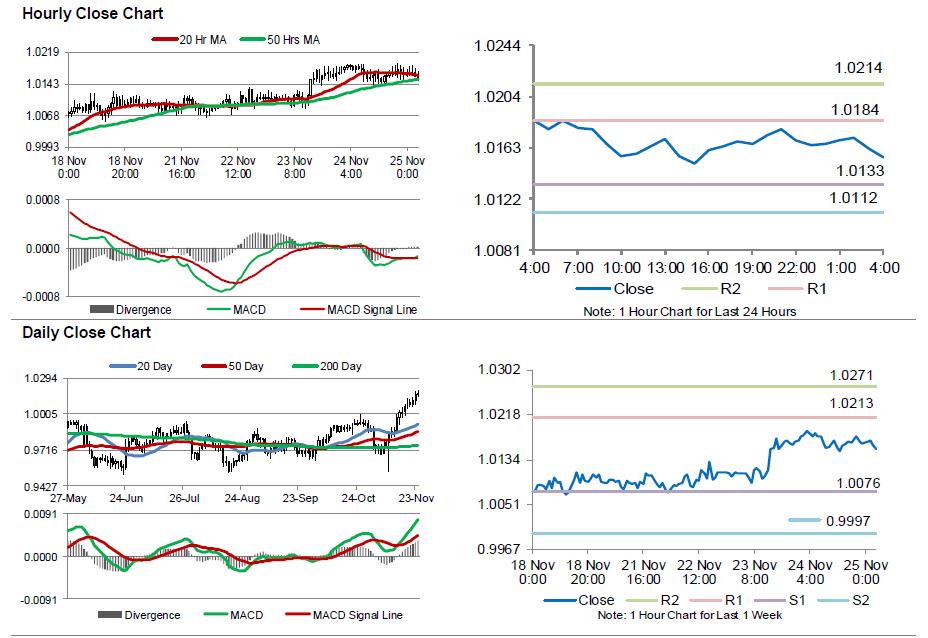

For the 24 hours to 23:00 GMT, the USD declined slightly against the CHF and closed at 1.0165.

Macroeconomic data indicated that, Switzerland’s annual industrial production rose by 0.4% in 3Q 2016, after recording a revised drop of 1.3% in the prior quarter.

In the Asian session, at GMT0400, the pair is trading at 1.0155, with the USD trading 0.1% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0133, and a fall through could take it to the next support level of 1.0112. The pair is expected to find its first resistance at 1.0184, and a rise through could take it to the next resistance level of 1.0214.

Moving ahead, investors will focus on Switzerland’s GDP for 3Q 2016, UBS consumption indicator and real retail sales, both for October, KOF leading indicator and SVME purchasing managers’ index, both for November, all slated to release next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.